What Is a Bear Call Spread? | Beginner's Guide

Bear call spreads explained visually—payoff diagrams, Greeks tables, and examples showing how the strategy works.

A bear call spread, or call credit spread, combines selling a call at a lower strike and buying a call at a higher strike—same expiration and underlying asset. This moderately bearish strategy has defined risk and limited profit potential. It’s one of the four vertical spread strategies (two strike prices, one expiration).

Bear call spreads work best when you’re bearish and expect the stock to stay below a specific price.

With the stock at $300, an example bear call spread would be:

- Sell one 315 call at $8.00

- Buy one 330 call at $3.00

- Net Credit: $5.00

Resulting Position: a 315 / 330 bear call spread entered for a net credit of $5.00.

Selling the 315 call naked would collect $8.00, but carry unlimited upside risk. Adding the long 330 call for $3.00 limits your maximum loss in exchange for less profit potential than selling the call on its own.

Payoff Diagram

The bear call spread payoff diagram has defined risk on the upside, and limited profit potential on the downside:

Stock at Entry: $300. Trade: 315/330 call credit spread entered for a $5.00 net credit. 60 days to expiration (DTE).

The white line shows the payoff at expiration. The max profit of $500 occurs if the stock price is at or below the short call strike of $315 (+5% buffer). The max loss of $1,000 occurs if the stock price is at or above the long call strike of $330 (stock rises 10%+).

The cyan line (T+0) shows the payoff right now (entry in this case). Profits and losses are muted before expiration because both options still have extrinsic value. The max profit/loss only occurs when extrinsic value is gone—either at expiration or when the spread is deep ITM/OTM.

Key Characteristics

- Max Profit: Net credit × 100 × number of spreads. Occurs if the stock closes at or below the short call strike at expiration.

- Max Loss: (Spread width − net credit) × 100 × number of spreads. Occurs if the stock closes at or above the long call strike at expiration.

- Breakeven: Short call strike + net credit

- Outlook: Moderately bearish

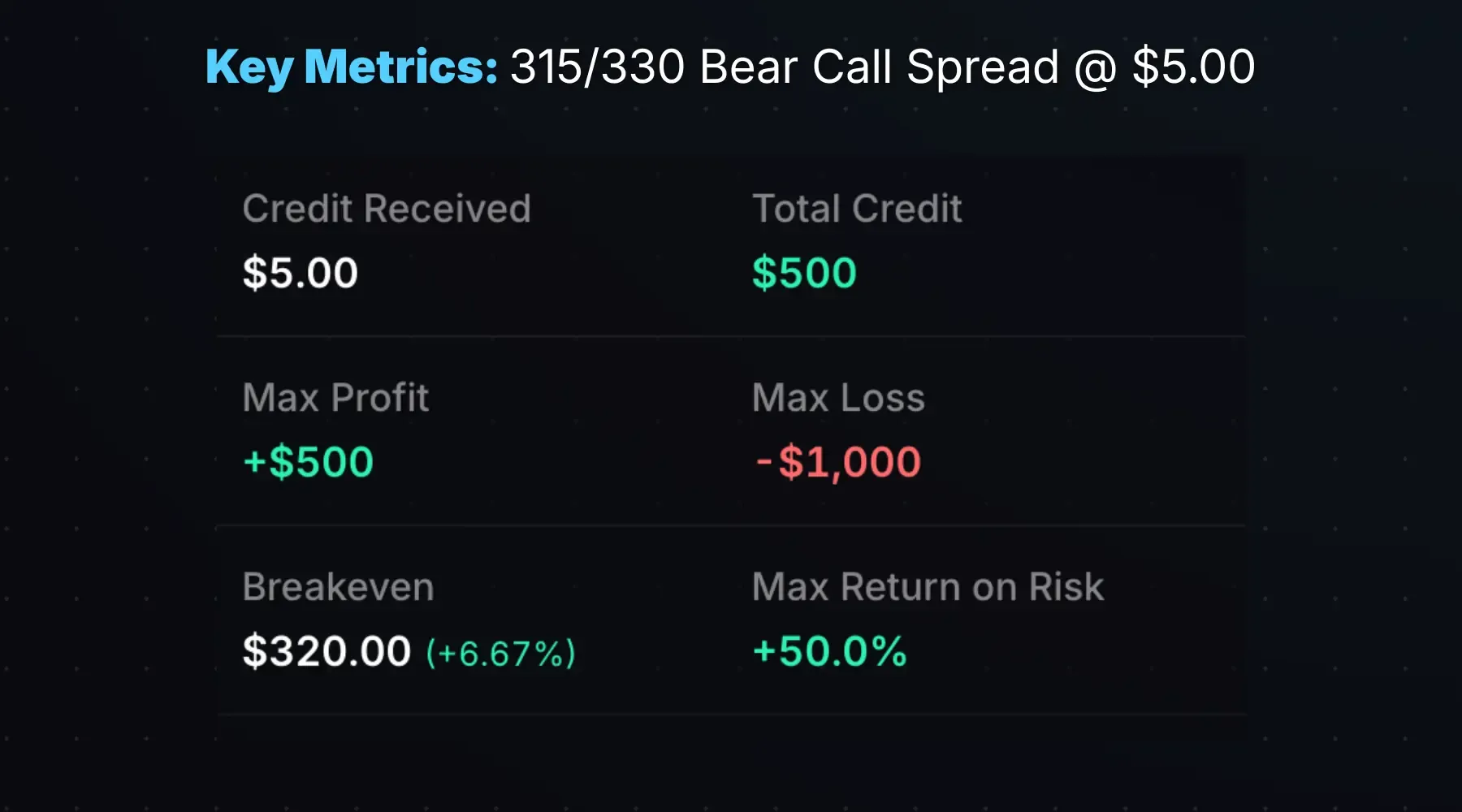

Here are the metrics for a 315/330 call spread sold for a $5.00 net credit:

- Max Profit: $500 (net credit × 100)

- Max Loss: $1,000 (spread width of $15 − $5 net credit = $10 × 100)

- Breakeven: $320 (short call strike + net credit)

- Max Return on Risk: +50%

Achieving the max profit requires the stock to be $315 or lower at expiration. As long as the stock price isn’t 5%+ higher at expiration, the position achieves max profit.

At $320 (breakeven), the spread value equals the credit received.

The max loss requires the stock to rise 10% or more by expiration (> $330).

How the Greeks Affect a Bear Call Spread

Vertical spread Greeks are nuanced—gamma, theta, and vega flip depending on where the stock is relative to the strikes.

| Greek | Near Short Strike | Near Long Strike |

|---|---|---|

| Delta (Δ) | Negative | Negative |

| Gamma (Γ) | Negative | Positive |

| Theta (Θ) | Positive | Negative |

| Vega (ν) | Negative | Positive |

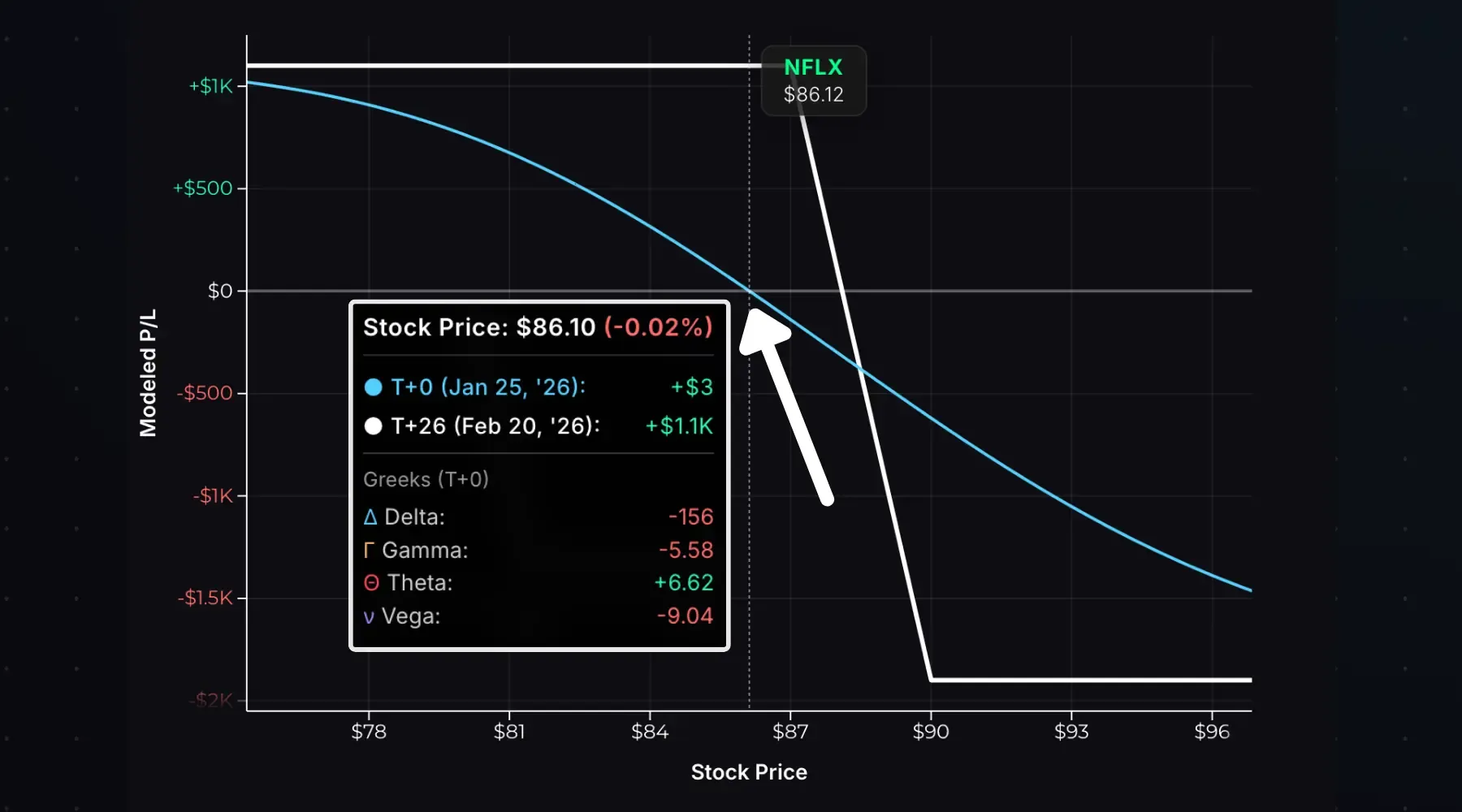

Here are ten 87/90 bear call spreads on NFLX with the stock below the short call strike:

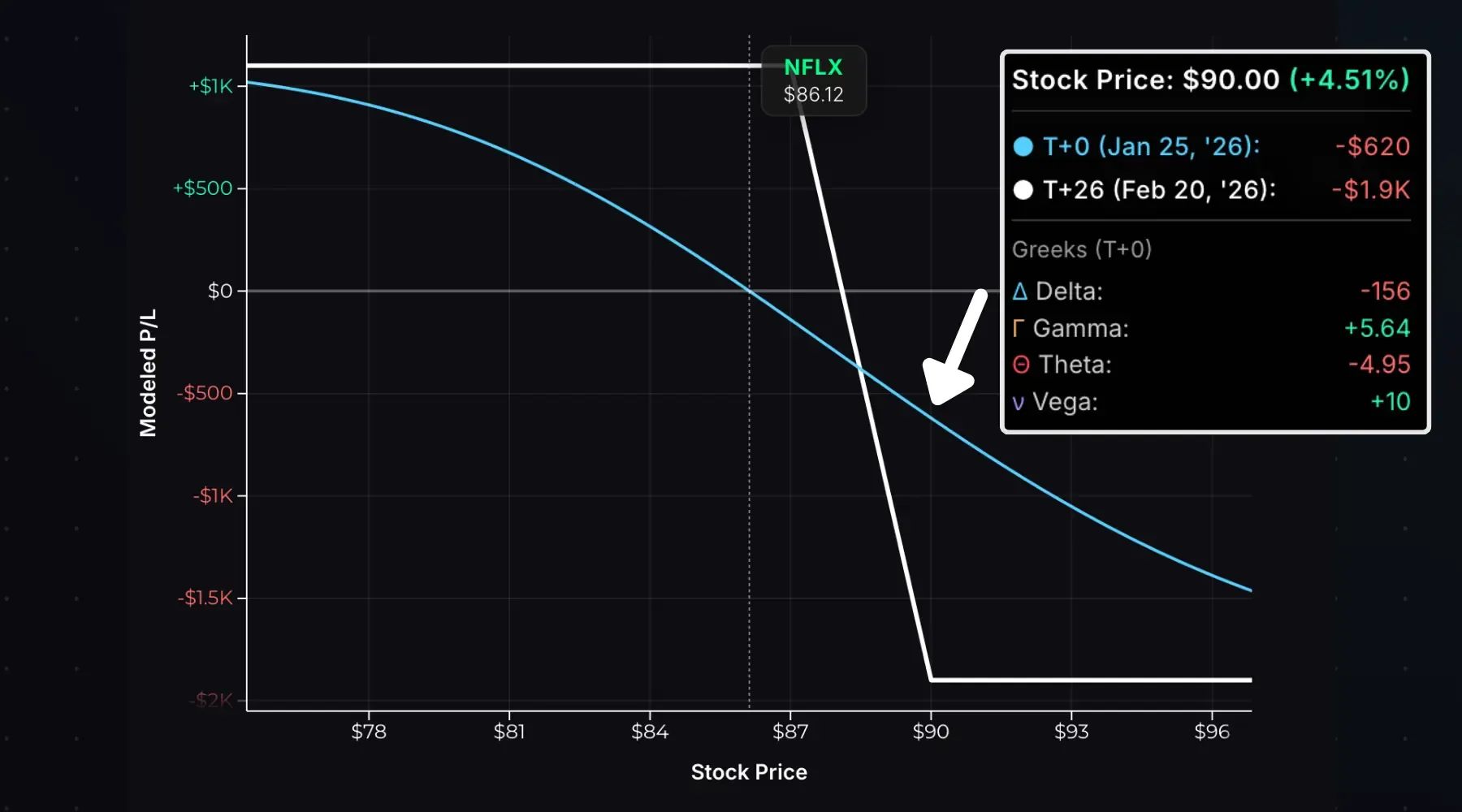

And with the stock at the long call strike ($90):

You can see the Greeks by comparing the T+0 line to the expiration line:

- Near the short strike ($87): T+0 is below the expiration P/L—profits grow as time passes (positive theta of +6.62). Falling IV helps because the short call loses more extrinsic value than the OTM long call.

- Near the long strike ($90): T+0 is above the expiration P/L—losses grow as time passes (negative theta of -4.95). Rising IV helps because the ATM long call has higher vega than the OTM short call.

A common claim is that “credit spreads are ideal when implied volatility is high”—implying falling IV helps. This is true when the spread is out-of-the-money. If the stock moves against you—toward the long strike, you want IV to rise, not fall.

Time Decay

Unlike a naked short call, a bear call spread has partially offsetting theta. The short call has positive theta and the long call has negative theta.

When the stock is near the short call strike, net theta is positive—time passing benefits your P/L. As the stock approaches the long strike, net theta flips negative—time starts working against you.

Choosing Strike Prices

Strike selection affects credit received, risk/reward, breakeven, and probability of profit.

It’s unusual to sell ITM credit spreads, so our baseline will be selling an ATM call and buying an OTM call.

Consider three $15-wide call spreads on a $300 stock with 60 DTE and 25% IV:

| Spread | Net Credit | Max Profit | Max Loss | Breakeven | Max Return |

|---|---|---|---|---|---|

| 300/315 (ATM) | $6.20 | $620 | $880 | $306.20 (+2.07%) | 70.5% |

| 315/330 (OTM) | $3.71 | $371 | $1,129 | $318.71 (+6.24%) | 32.9% |

| 330/345 (OTM) | $1.95 | $195 | $1,305 | $331.95 (+10.65%) | 14.9% |

The ATM spread collects the most credit, but has the lowest probability of profit—the stock can only rise 2.07% before the position loses money at expiration. The max return is 70.5%, risking $880 to make $620.

The deep OTM spread collects the least credit, but has the highest probability of profit—the stock can rise 10.65% before the position loses money at expiration. The max return is 14.9%, risking $1,305 to make $195.

Key Insight: Pushing strikes further OTM decreases reward and increases risk, but raises the breakeven and increases the probability of profit.

-

ATM Spreads: lower probability, higher payoff.

-

OTM Spreads: higher probability, lower payoff.

Use the bear call spread calculator to model different strike combinations.

Choosing an Expiration

A bear call spread’s max profit occurs when both options lose all extrinsic value—typically at expiration. Even when your spread is fully OTM, you need time decay to finish the job.

Compare two 87/90 call spreads on NFLX at $86.12 (10 spreads). First, 26 DTE:

Theta is +$6.62/day. The spread reaches max profit at expiration (+26 days) if the stock stays below $87.

Now the same call spread strikes, but in the 54 DTE expiration:

Theta is +$1.80/day. The spread reaches max profit at expiration (+54 days) if the stock stays below $87.

Quick summary:

| Shorter-Term | Longer-Term | |

|---|---|---|

| Theta Decay | Faster | Slower |

| Credit Collected | Less | More |

| Gamma Risk | Higher (adverse moves hurt more) | Lower |

| Margin for Error | Less | More |

The sweet spot for credit spreads is around 30-45 DTE, but these aren’t hard boundaries. In this timeframe, you can sell call spreads far enough OTM to give yourself room for stock price movements, but not so far out in time that you’re locked into a slowly-decaying position. Go shorter-term (< 30 DTE) and you’ll need to sell call spreads much closer to the stock price to collect decent premiums, leaving little room for error and exposing yourself to rapid changes in P/L (high gamma risk).

Bear Call Spread vs Bear Put Spread

Both spreads are synthetically equivalent using the same strikes:

- 100/110 bear call spread: short 100 call, long 110 call

- 100/110 bear put spread: long 110 put, short 100 put

Both reach the max profit below $100, and hit max loss above $110 at expiration.

So which one should you use? Avoid selling ITM options—use whichever spread keeps your short strike OTM.

Example #1: NVDA is at $185. You think it’s going to $175 or lower.

A 170/200 bear put spread sells the OTM 170 put. A 170/200 bear call spread sells the ITM 170 call. Use the put spread here.

Example #2: NVDA is at $185. You think it’s going to stay below $200.

A 200/210 bear put spread sells the ITM 200 put. A 200/210 bear call spread sells the OTM 200 call. Use the call spread here.

Key Insight: If your spread construction requires selling an ITM option, flip to the other spread type.

Early Assignment

The short call in your spread can be assigned early if it’s ITM before expiration.

If your short call is assigned, you sell (short) 100 shares at the short call strike price.

You still own the long call, so your risk remains defined, but your profit potential becomes uncapped since you have short stock instead of a short call. To close the position, you can:

- Exercise your long call to buy shares at the long strike, realizing max loss. This only makes sense if the long call is deep ITM with little extrinsic value. You wouldn’t exercise a call with lots of extrinsic value.

- Hold the short shares if you’re bearish, with the long call as protection

- Buy back the shares and sell the long call in the same closing transaction to close the position

Early assignment typically happens when the short call is deep ITM with little extrinsic value remaining, or the stock has an upcoming ex-dividend date.

This means if you have 30 DTE and your short call is only slightly ITM (100 short call and the stock is at $102), the option likely has significant extrinsic value remaining, and your risk of early assignment is low. Pay attention to the extrinsic value in the short call—if it’s close to zero, early assignment risk is high, especially with an upcoming dividend.

Entry, Exit, and Expiration

To enter: Place a spread order to sell the lower strike call and buy the higher strike call simultaneously. You’ll receive a credit to enter the trade.

To exit before expiration: Close the spread by buying back the short call and selling the long call in a single order. You’ll pay a debit when exiting the trade. Your profit or loss per spread will be the difference between the net credit at entry and net debit at exit.

If you hold the spread through expiration:

| Scenario | Stock Price | Result |

|---|---|---|

| Both Calls OTM | ≤ Short strike | Both calls expire worthless. Max profit. |

| Partially ITM | Between strikes | Short call assigned, long call expires. You short 100 shares per short call. |

| Both Calls ITM | ≥ Long strike | Short call assigned and long call exercised—net zero shares. Max loss. |

Using an 87/90 call spread entered for $1.50 credit that’s held through expiration:

- Stock at $85: Both calls expire worthless. You keep the $150 credit.

- Stock at $88: Short call auto-assigns (short shares at $87). Long call expires. You’re short 100 shares at $87, but the $1.50 credit you collected at entry gives you an $88.50 breakeven—you don’t lose money unless the stock rises above that.

- Stock at $95: Short call assigns, long call exercises. You sell 100 shares at $87 and buy at $90—a $300 loss on the shares, minus the $150 credit = $150 net loss (max loss realized).

Avoid the partially ITM scenario. If your short call is assigned while the long expires worthless, you’ll end up shorting shares—leaving you with unlimited upside risk instead of the defined-risk spread you started with.

- A bear call spread is a moderately bearish strategy with defined risk and limited profit potential.

- Max profit = net credit × 100 × number of spreads. Max loss = (spread width − net credit) × 100 × number of spreads. Breakeven = short call strike + net credit.

- Gamma, theta, and vega flip as the stock moves from the short strike to the long strike.

- Deep OTM spreads have higher probability but lower reward; Near ATM spreads have lower probability but higher reward.

- Bear call spreads profit when the stock stays flat, falls, or rises slightly and your spread stays OTM—a high probability trade.

- Early assignment on the short call means shorting shares—your long call keeps risk defined, but you’ll need to manage the position.

- A bear call spread is a moderately bearish strategy with defined risk and limited profit potential.

- Max profit = net credit × 100 × number of spreads. Max loss = (spread width − net credit) × 100 × number of spreads. Breakeven = short call strike + net credit.

- Gamma, theta, and vega flip as the stock moves from the short strike to the long strike.

- Deep OTM spreads have higher probability but lower reward; Near ATM spreads have lower probability but higher reward.

- Bear call spreads profit when the stock stays flat, falls, or rises slightly and your spread stays OTM—a high probability trade.

- Early assignment on the short call means shorting shares—your long call keeps risk defined, but you’ll need to manage the position.

Related Guides

- What Is a Bear Put Spread? — Bearish debit spread alternative

- What Is a Bull Call Spread? — Bullish debit spread alternative

- What Is a Covered Call? — Sell calls for income on stock you own

- What Is Delta? — How option prices change with the stock price

- What Is Theta? — Understanding time decay

Ready to model your own spreads? Use our Bear Call Spread Calculator to visualize P/L for any strike combination.