What Is Theta in Options Trading?

Learn what theta means in options trading, how time decay affects option prices, and why different options have different decay curves.

Theta measures how much an option’s price decays each day as expiration approaches. It’s the daily cost of holding an option when nothing else changes—often called time decay.

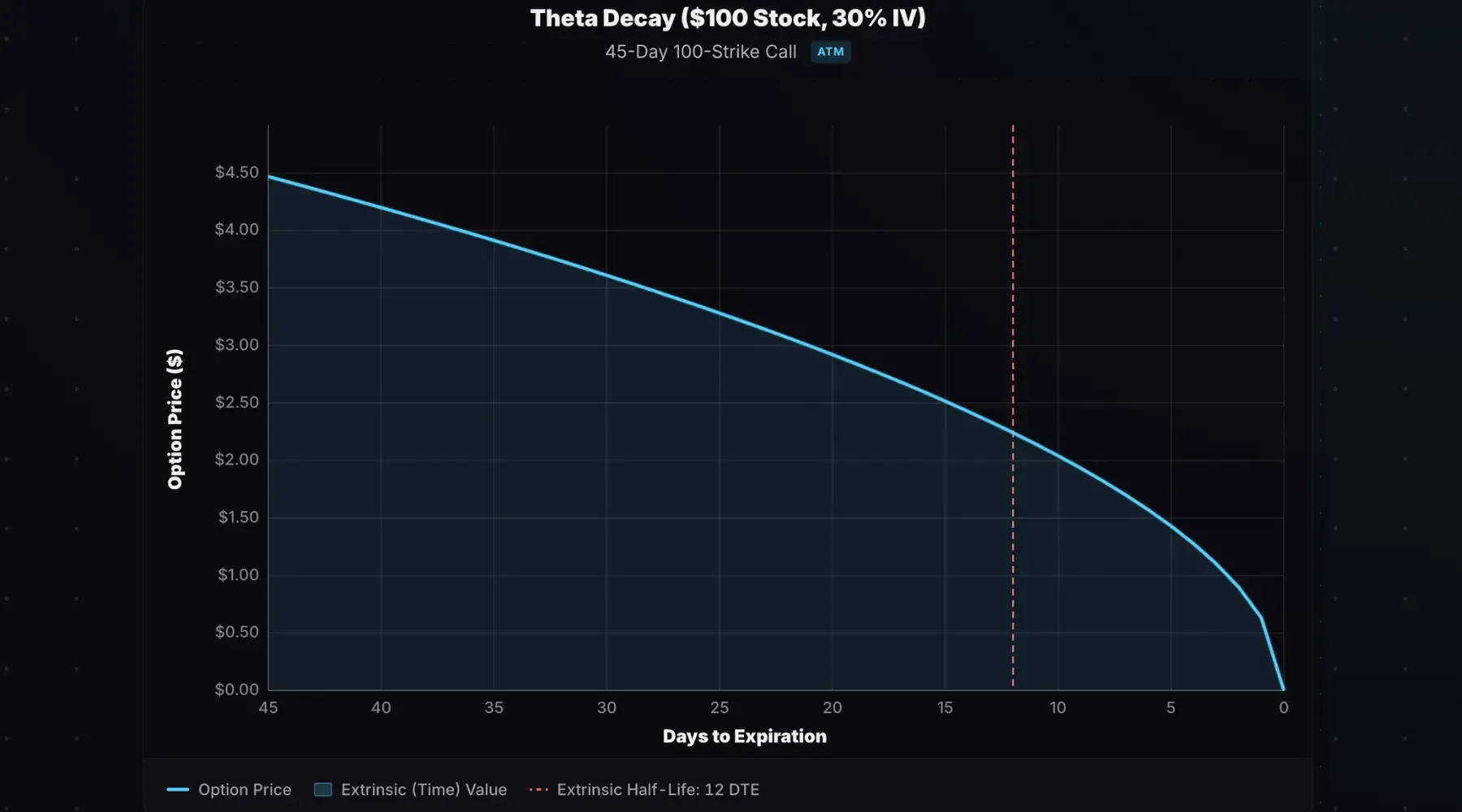

With stock price and implied volatility held constant, an ATM call loses value slowly at first, then accelerates into expiration:

How Theta Works

When an option has lots of time until expiration, there’s plenty of time for the stock to move and increase the value of that option. But as expiration approaches, the option has less time to gain value through stock price movements. The option’s window to become profitable is shrinking fast, and the price reflects that.

Theta quantifies this daily erosion. If you own a call with a theta of −0.08, its price is expected to fall by $0.08 per day—$8 per contract.

Long Options Have Negative Theta

When you buy options—calls or puts—you have negative theta. Time works against you.

Every day that passes without a favorable stock move costs you money. The stock needs to move in your favor to offset decay.

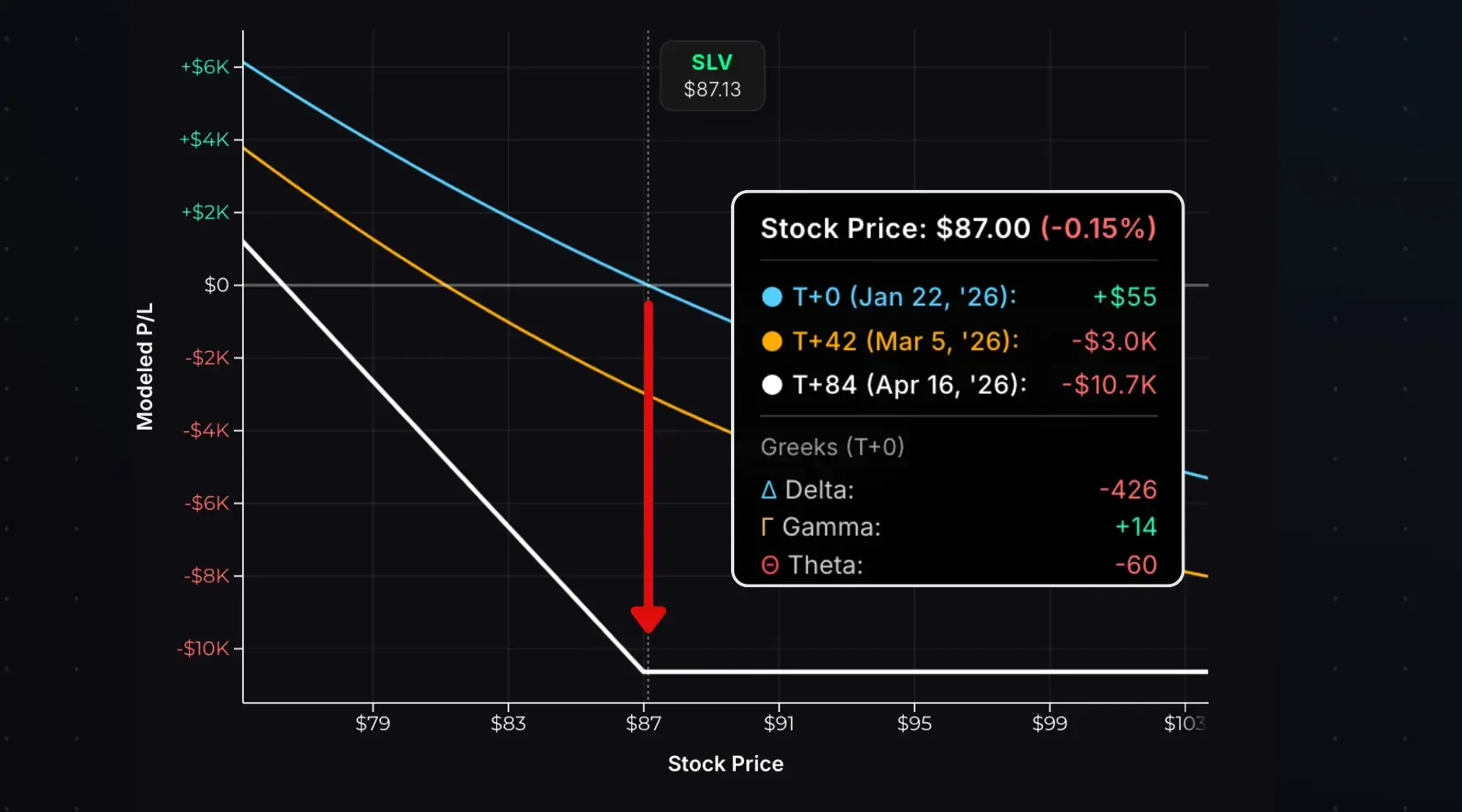

P/L curves for 10 SLV put contracts at the $87 strike with 84 days to expiration:

The position theta is −60. This position loses $60 per day to time decay. The T+42 line shows a P/L of −$3,000—in 42 days this position is down $3,000 if the stock doesn’t move. At expiration? A total loss of $10,700.

Short Options Have Positive Theta

When you sell options, you have positive theta. Time works for you because you want option prices to decrease. If you sell an out-of-the-money put, you want it to expire worthless—which happens as time passes.

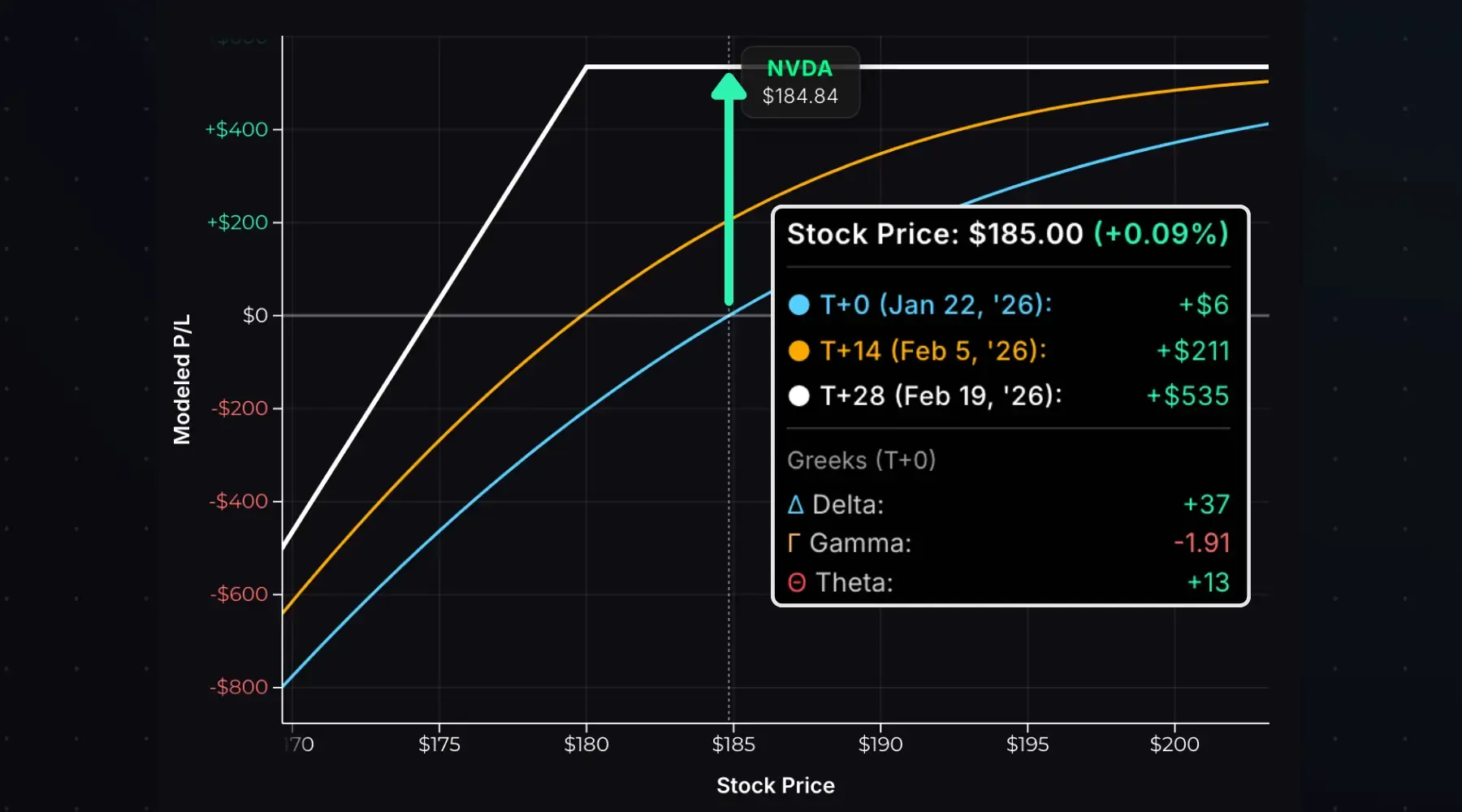

P/L curves for short NVDA put options at the $180 strike with 28 days to expiration:

The position theta is +13. This position gains $13 per day from time decay. The T+14 line shows a P/L of +$211—in 14 days this position gains approximately $211 if the stock doesn’t move. At expiration, the put expires worthless and maximum profit of $535 is achieved.

| Position | Option Theta | Position Theta |

|---|---|---|

| Long Call | −0.06 | −$6/day |

| Short Call | −0.06 | +$6/day |

| Long Put | −0.05 | −$5/day |

| Short Put | −0.05 | +$5/day |

Why Theta Decay Isn’t Linear

Options don’t decay at a constant rate—daily decay accelerates or slows depending on the option’s moneyness (the relationship between strike and stock price).

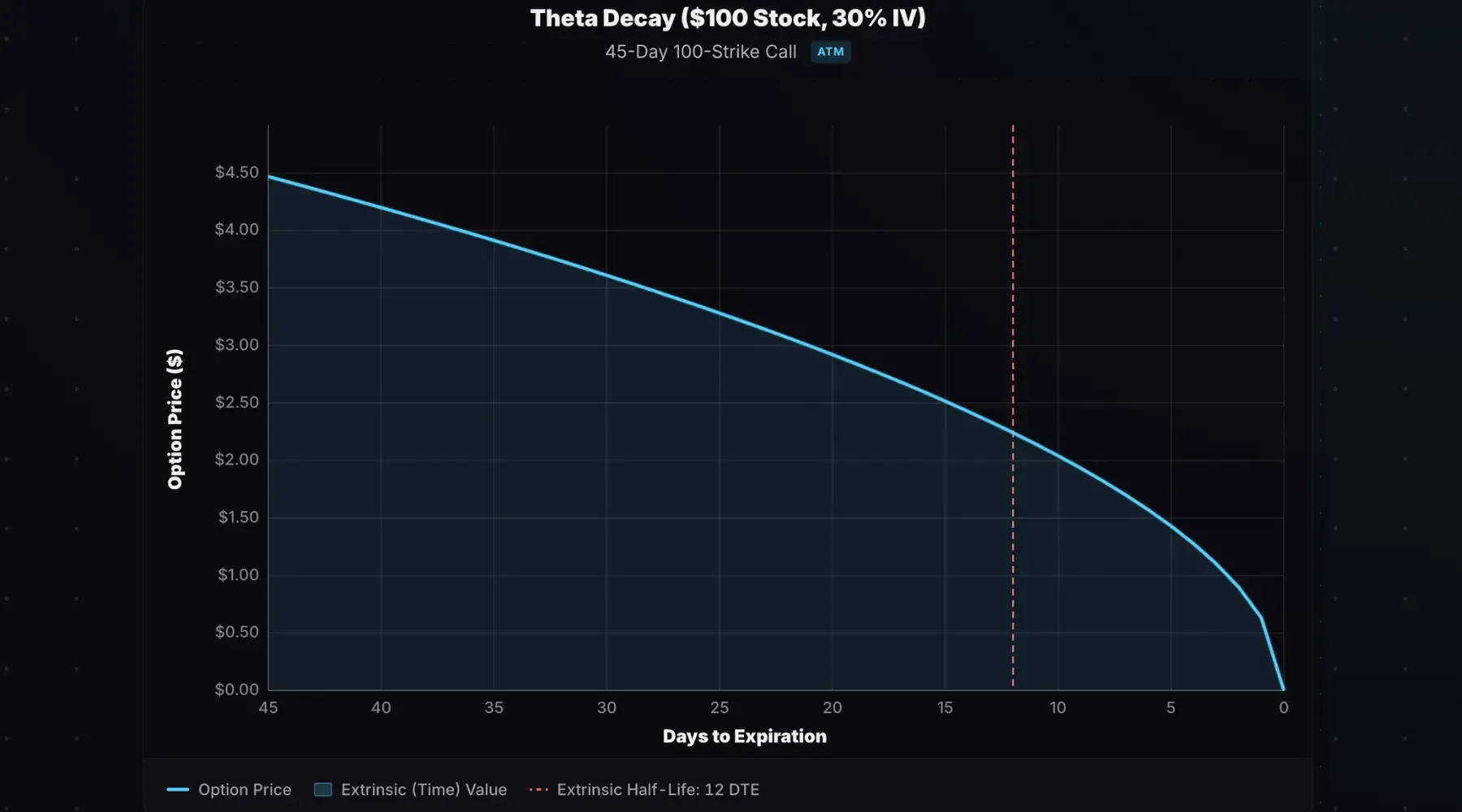

At-the-money options experience moderate decay initially, then rapid acceleration in the final days before expiration:

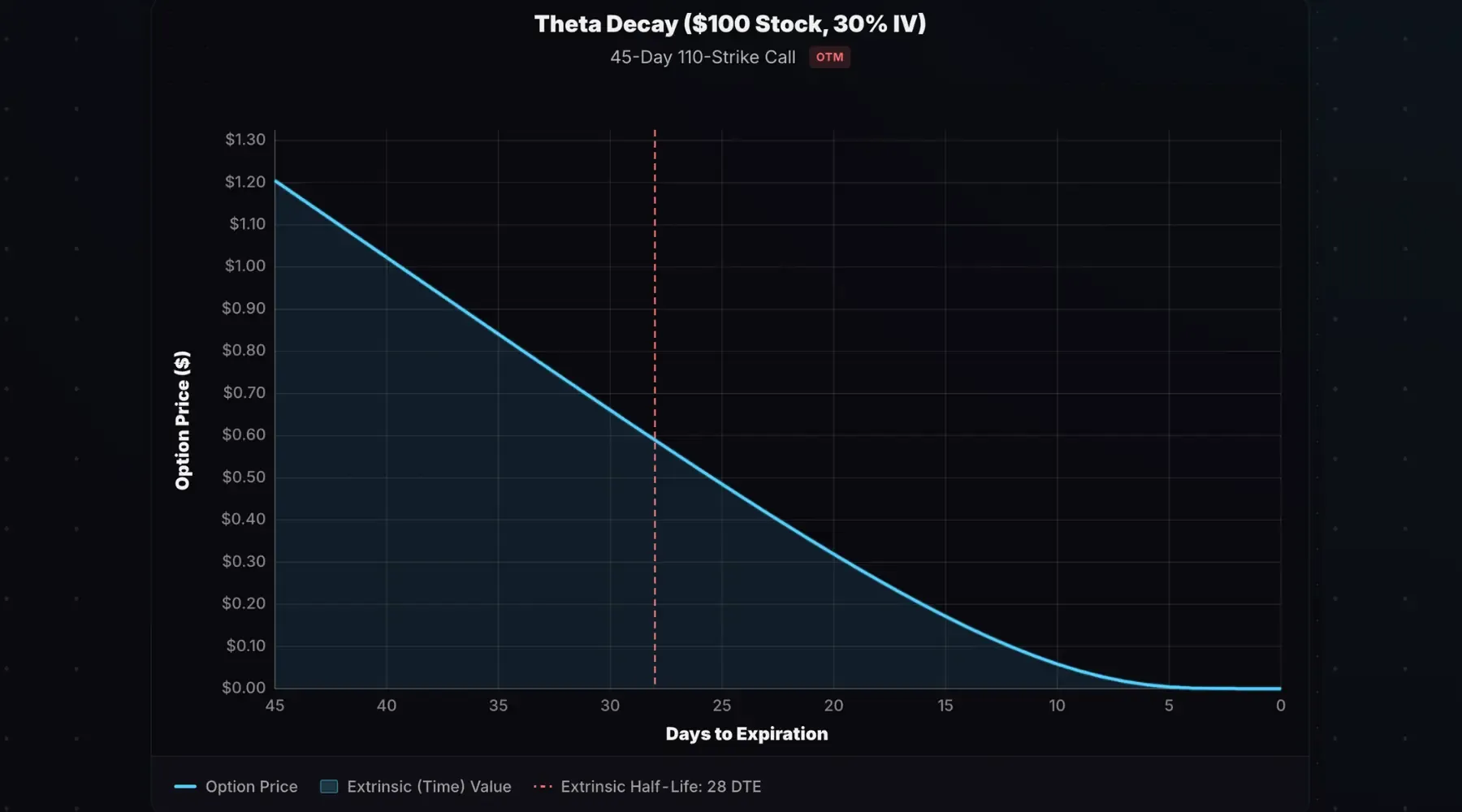

ITM and OTM options decay more linearly until most extrinsic value is gone—then decay slows since there’s little left to lose:

With the stock at $100, this 45-day 110-strike call loses most of its value by 10–15 days to expiration. At 5 DTE, the option is nearly worthless—there’s almost no chance it expires ITM.

Use the Theta Decay Curve Calculator to visualize decay for any option.

How Implied Volatility Affects Theta

Theta measures how fast extrinsic value erodes. Implied volatility determines how much extrinsic value exists in the first place.

Higher IV means more extrinsic value. More extrinsic value decaying over the same timeframe means faster daily decay.

Consider a $100 stock with 30-day ATM options at two IV levels:

At 25% IV, the call is priced at $3.06 with theta of −0.05. At 75% IV, the same call is $8.75 with theta of −0.15—three times the daily decay.

Both options are pure extrinsic value (ATM strike). Both decay to zero if the stock stays at $100. The high-IV option simply has more ground to cover in the same number of days.

Why Only Extrinsic Value Decays

Option prices have two components: intrinsic value and extrinsic value. Only extrinsic value is exposed to theta.

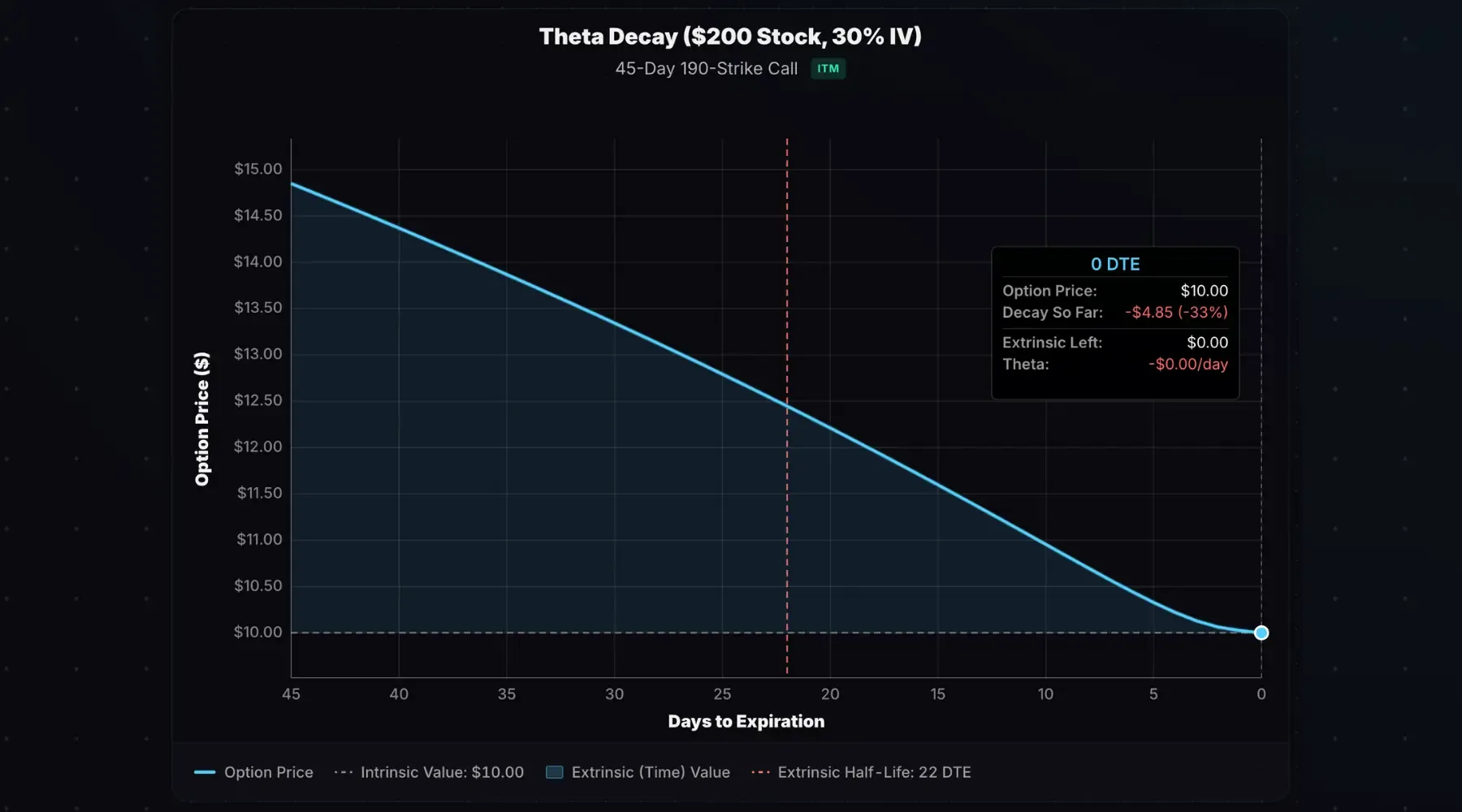

A 190-strike call has $10 of intrinsic value with the stock at $200. If the stock stays at $200, this call decays toward $10—not zero:

The chart shows a 33% loss over 45 days—that’s the extrinsic value disappearing. The intrinsic value remains.

This is why some traders prefer buying ITM options and selling OTM options. ITM options have intrinsic value that’s sheltered from decay. OTM options are pure extrinsic value with no protection.

Theta is working for or against you on every option position. Know which side you’re on before entering the trade.

Next: What Is Vega? — Learn how implied volatility affects option prices.

Related Resources

- Theta Decay Curve Calculator — Visualize how options decay over time

- Options Pricing Calculator — Calculate theta and other Greeks

- What Is Delta in Options Trading? — Directional risk explained

- Options Greeks Overview — Learn about all four primary Greeks