What Is Vega in Options Trading?

Learn what vega measures in options trading, how it relates to implied volatility, and how to manage volatility exposure in your positions.

Vega measures how much an option’s price changes when implied volatility moves by 1%. Option prices are driven by the market’s expectations of future stock movement—vega quantifies your exposure to shifts in those expectations.

How Vega Works

Consider this hypothetical at-the-money call option with 30 days to expiration. Watch how the price shifts when IV moves 1% in either direction:

If IV rises to 26%, the call increases to $3.17. If IV drops to 24%, the call falls to $2.95—$0.11 per 1% IV change, as vega predicts.

Vega answers: how much does my option’s value change if volatility expectations shift?

What Is Implied Volatility?

Historical volatility (HV) looks backward—the actual price movement a stock exhibited over a past period. It’s known.

Implied volatility (IV) looks forward—the market’s expectation of future price movement, expressed through option prices. Use our IV calculator to derive IV from any option’s market price, or read What Is Implied Volatility? for a deeper understanding.

A stock with 50% IV is expected to move more than a stock with 15% IV over the same timeframe. The charts below show how IV affects the expected price distribution for a $100 stock over 30 days:

Low IV produces a tall, narrow curve—the market expects the stock to stay close to $100. High IV produces a short, wide curve—many more outcomes are considered probable. Options cost more when IV is high because they’re exposed to a larger range of potential stock prices.

Why Implied Volatility Changes

IV is derived from option prices, which are driven by supply and demand.

If traders aggressively buy options expecting a big move, prices rise. Since IV is backed out of option prices, higher prices mean higher IV. The reverse happens when traders sell—prices drop, IV falls.

Useful interpretation: if an option’s price increases by its vega with no change in stock price or time, IV has risen by approximately 1%.

How Vega Changes with Price and Time

Vega and Strike Price

Vega is highest for at-the-money options and decreases for strikes further ITM or OTM:

ATM options sit at the center of the expected price distribution. When IV increases, the distribution widens. ATM options experience the largest price shift because they’re positioned in the middle of the expected move.

Here’s a concrete example using the Black-Scholes pricing model. Stock is $100, strike is $100, 30 DTE:

IV doubling from 25% to 50% increases both the call and put by $2.85.

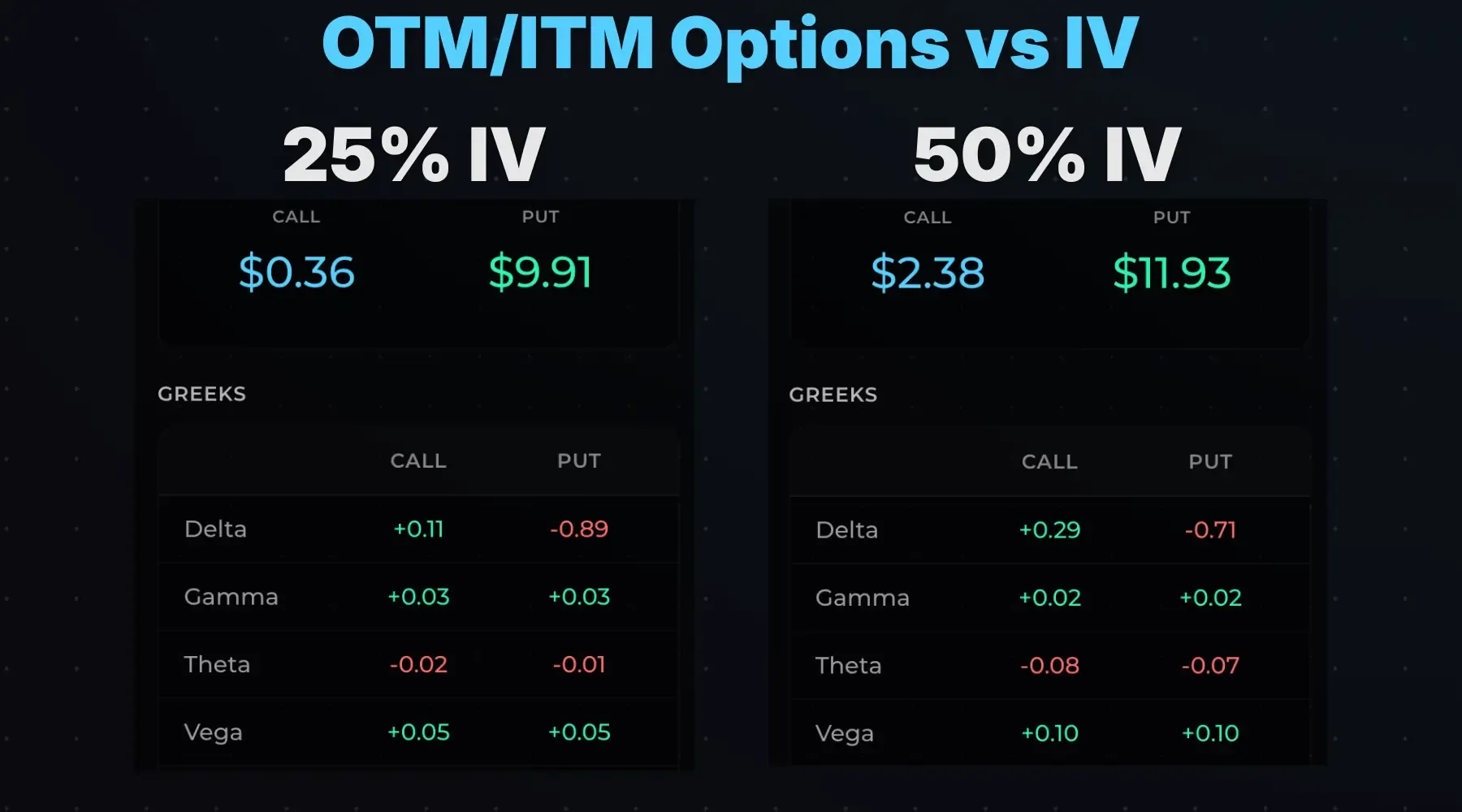

Now compare that to a $110 strike—a deep OTM call and deep ITM put:

The same IV increase adds $2.02 to each option. Still notable, but muted compared to ATM.

Vega as Expiration Approaches

Vega decreases as expiration approaches. More time means more vega; less time means less vega.

Compare a 100-strike ATM call on a $100 stock at 25% IV:

| DTE | Price at 25% IV | Price at 50% IV | Difference |

|---|---|---|---|

| 365 | $12.33 | $21.78 | +$9.45 |

| 1 | $0.53 | $1.05 | +$0.52 |

With a year to expiration, doubling IV expands the expected move substantially in dollar terms. With one day left, even a massive IV increase barely moves the needle—there’s little time for that volatility to materialize.

How Vega Affects Theta

When IV increases, extrinsic value grows. But that extrinsic value still decays to zero by expiration. More extrinsic value over the same timeframe means faster daily decay.

Compare theta on 30-day ATM options at different IV levels:

Notice the more negative theta in the 50% IV scenario. The high-IV call has $5.91 of extrinsic value to lose; the low-IV call has $3.06.

If you’re long options through a big IV spike, time decay will eventually eat all of the extrinsic value gained.

If you’re short options through a big IV spike, you’ll suffer unrealized losses initially, but decay works harder in your favor going forward.

Position Vega

An option’s vega tells you price sensitivity per contract. Your position’s vega depends on contract count and direction.

Position Vega = Option Vega × 100 × Contracts × Direction (+1 long, −1 short)

Long Vega

Long vega means you profit when IV increases and lose when IV decreases.

Example: You’re long a straddle—one call and one put—each with +0.11 vega.

| Leg | Calculation | Position Vega |

|---|---|---|

| Long Call | +0.11 × 100 × 1 | +11 |

| Long Put | +0.11 × 100 × 1 | +11 |

| Total | +22 |

A 1% IV increase adds ~$22 to P/L. A 1% decrease subtracts $22. With 100 straddles, position vega becomes +2,200.

Long Vega Strategies: All options strategies where options are purchased. For options with both long and short legs, vega depends on the stock price relative to the strikes, and the quantities of each option.

Short Vega

Short vega means you profit when IV decreases and lose when IV increases.

If you’re short the same straddle, rising option prices hurt you. Position vega flips to −$22.

Short Vega Strategies: All options strategies where options are sold short. For options with both long and short legs, vega depends on the stock price relative to the strikes, and the quantities of each option.

For multi-leg strategies, vega exposure is dynamic—it shifts with the stock price. A bull call spread is long vega near the long strike but becomes short vega as the stock moves toward the short strike.

Managing Vega Exposure

When Long Vega Hurts

IV is elevated and likely to fall. After a big stock move, option markets price in higher volatility. Buying options in this environment is risky—if the price action simply calms down, IV will collapse and your options lose value even if the stock doesn’t move against you.

When IV is extremely elevated, heightened volatility must continue for long vega positions to profit. If it doesn’t, the IV contraction destroys your position.

When Short Vega Hurts

IV is cheap and has room to expand. When IV percentile is historically low, there’s more upside than downside in IV.

Short straddles, strangles, or iron condors in low-IV environments face outsized risk if IV mean-reverts higher. That said, low IV doesn’t guarantee a spike—in products like SPY, low volatility is often the norm.

Just understand the risk: selling options at rock-bottom IV means any volatility expansion creates immediate pain. Fortunately, if your options consist mostly of extrinsic value, time decay will eventually work through those unrealized losses.

Know your vega exposure before entering—and decide whether it aligns with your expectations for the stock’s volatility going forward.

Complete: You’ve learned all four primary Greeks. Review the Greeks or calculate the price and Greeks for any option.

Related Resources

- What Is Delta in Options Trading? — Directional exposure explained

- What Is Gamma in Options Trading? — Delta sensitivity explained

- What Is Theta in Options Trading? — Time decay explained

- Implied Volatility Calculator — Calculate IV from option prices