Strangle Calculator

Visualize the profit and loss for long and short strangle positions.

Strangle Parameters

Key Metrics

Enter parameters and calculate to see results.

Enter parameters and calculate to view P/L chart

Free 160-Page Options Guide

Clear visuals and real examples for every essential concept.

What Is a Strangle?

The strangle options strategy combines a call and put at different strike prices with the same expiration. Strangles can be bought (long strangle) or sold (short strangle).

Long strangles pay a debit and profit from big moves in either direction. Short strangles collect a credit and profit when the stock stays between the two strikes.

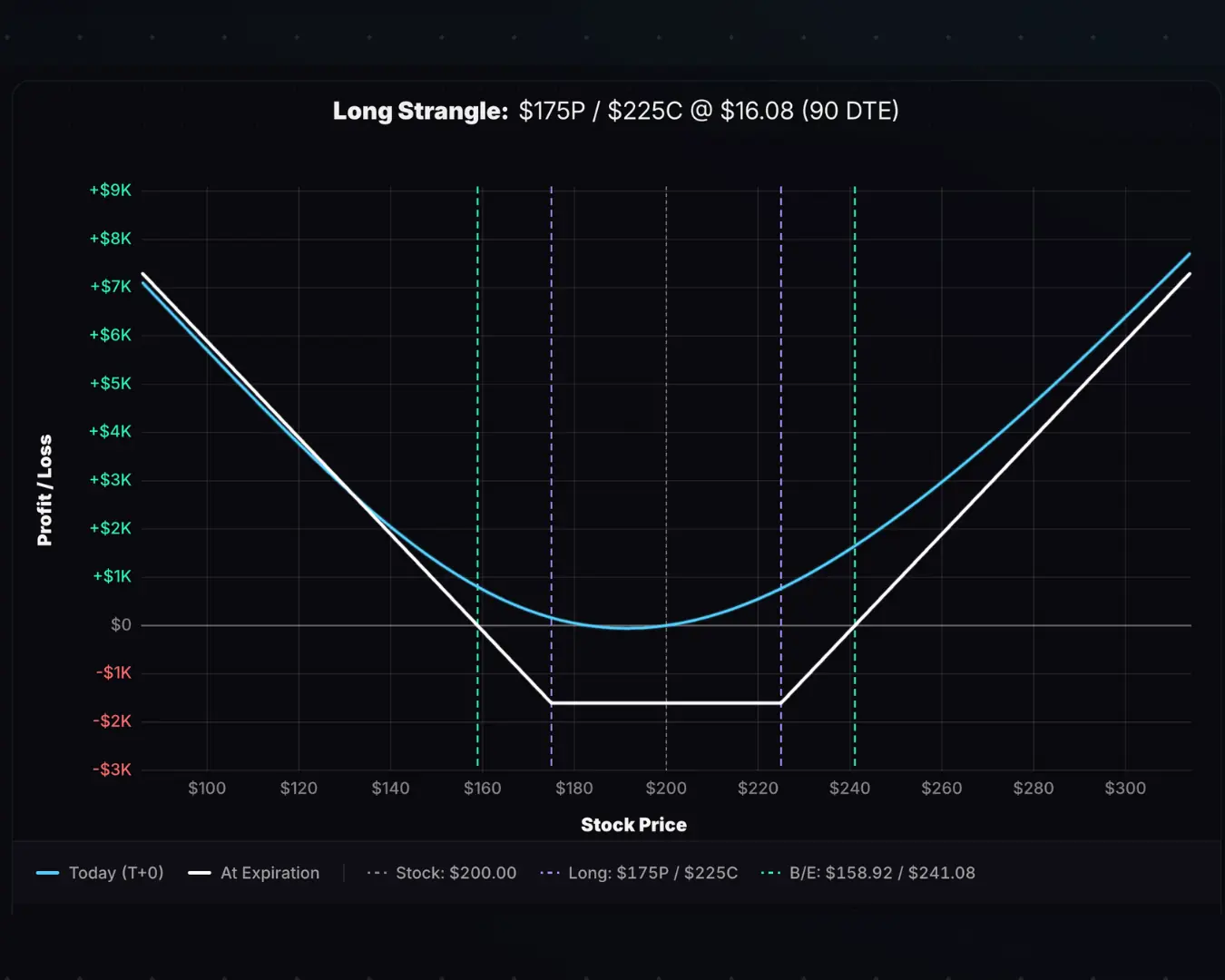

Long Strangle

A long strangle consists of buying an OTM call and an OTM put. You pay a debit at entry and profit when the stock moves far enough in either direction to overcome the cost.

Time decay works against you—both options lose value each day the stock doesn't move enough in either direction. Long strangles are cheaper than straddles because both options are OTM, but they require an even larger move to profit.

Key Characteristics

- Max Profit: Unlimited on the upside; put strike price − debit on the downside.

- Max Loss: Debit paid. Occurs when the stock price closes between the strikes at expiration.

- Breakevens: Put strike − debit (lower), Call strike + debit (upper)

- Outlook: Expecting a large move but unsure of direction, or expecting a large IV increase

What Is a Long Strangle? — Full strategy guide with examples

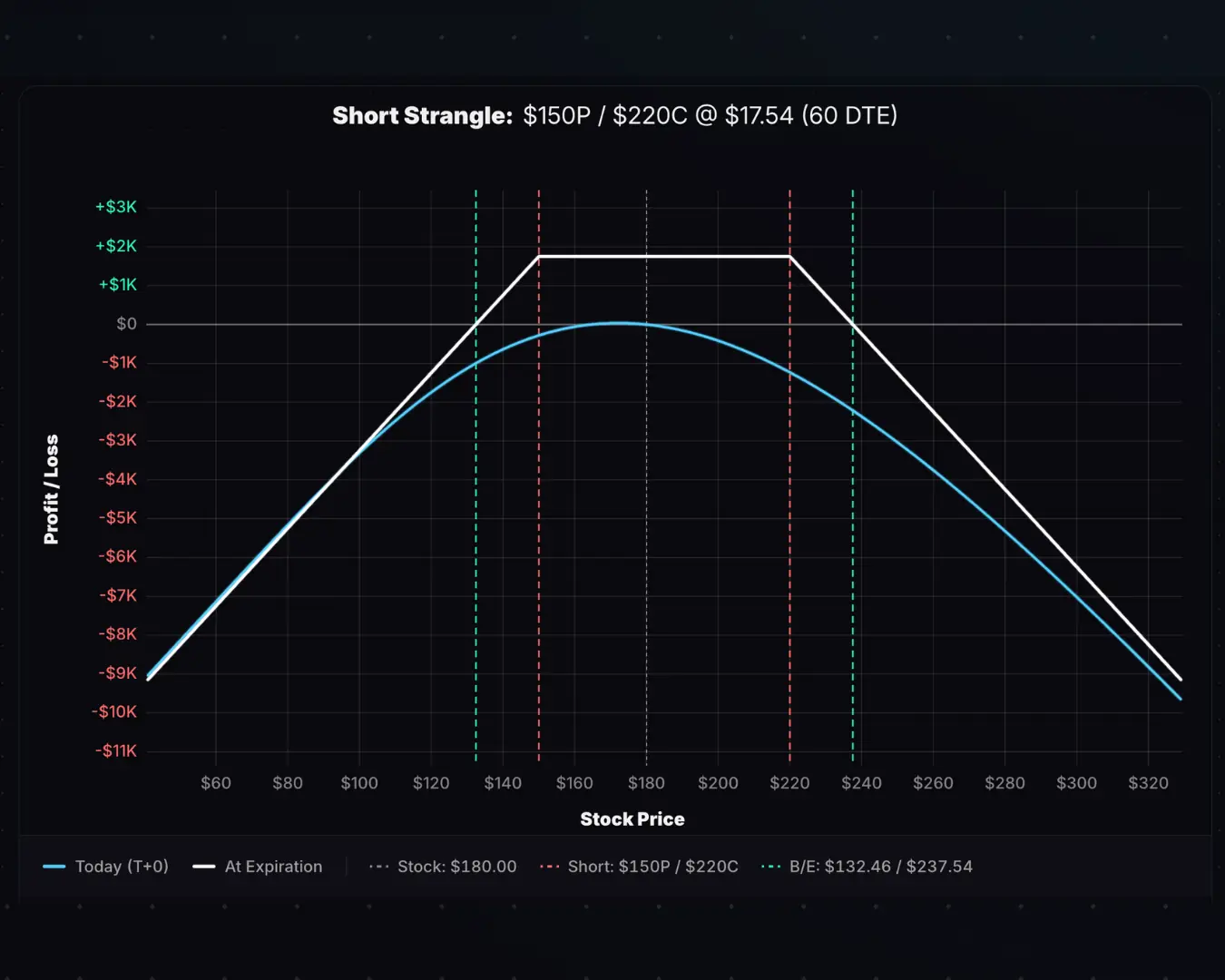

Short Strangle

A short strangle combines selling an OTM call and an OTM put in the same expiration and underlying asset. You collect a credit at entry and profit when the stock stays between the strikes as expiration approaches.

Time decay works in your favor as both options lose value each day. Short strangles collect less credit than straddles, but have a wider profit zone since the strikes are further apart.

Key Characteristics

- Max Profit: Credit received. Achieved when the stock closes between the strikes at expiration.

- Max Loss: Unlimited on the upside; put strike price − credit on the downside.

- Breakevens: Put strike − credit (lower), Call strike + credit (upper)

- Outlook: Neutral—expecting minimal movement

Reading the P/L Chart

The white line (Expiration) shows the P/L at expiration. For a short strangle, it's flat between the strikes—where both options expire worthless and you keep the full credit. For a long strangle, the expiration P/L is lowest between the strikes and increases as the stock moves beyond either long strike.

The cyan line (T+0) shows the theoretical P/L today. The gap between the two lines represents extrinsic value yet to decay. As expiration approaches, the T+0 P/L converges toward the Expiration P/L.

Strangle vs. Straddle

A straddle uses the same strike for both legs. A strangle uses different strikes—an OTM call and an OTM put. Strangles cost less (for long) or collect less credit (for short) because both options are OTM. Strangle buyers require a bigger move to profit; strangle sellers get a wider profit zone.

Assignment Risk

Short strangles carry assignment risk. If assigned early or at expiration, your short option converts into a stock position. When combined with the remaining leg, you end up with a covered call or put:

| Assigned Option | Resulting Position | Strategy Name |

|---|---|---|

| Short Put (ITM) | +100 shares + Short Call | Covered call |

| Short Call (ITM) | −100 shares + Short Put | Covered put |

Early assignment becomes likely only when the ITM option has little extrinsic value remaining—or when a short ITM call approaches an ex-dividend date. If the option still has meaningful extrinsic value, early assignment is unlikely.

If held through expiration, whichever option is ITM will be exercised (long) or assigned (short). Plan to close or roll the position before expiration to avoid assignment.

What Is a Short Strangle? — Full strategy guide with examples

Related Calculators

- Straddle Calculator — Call and put at the same strike

- Iron Condor Calculator — Defined-risk strangle alternative

- Iron Butterfly Calculator — Defined-risk straddle alternative