What Is a Long Call Option? | Beginner's Guide

Long call options explained visually—payoff diagrams, Greeks tables, and examples showing how the strategy works.

A long call is buying a call option—giving you the right (but not the obligation) to purchase 100 shares of the underlying stock at a predetermined strike price at or before expiration. This strategy provides leveraged upside exposure while limiting your risk to the premium paid.

Long calls work best when you’re bullish and expect a significant move higher within a specific timeframe, want to express conviction with leverage, or are positioning ahead of catalysts.

Payoff Diagram

Every long call has the same payoff structure at expiration: limited loss below the strike price, then rising linearly above the strike price (stock-like):

Call Strike: $50. Premium: $2.22 ($222 total). Breakeven at $52.22. 60 days to expiration (DTE).

The white line shows the long call’s payoff at expiration. If the stock price is at or below the strike of $50, the call expires worthless, but the risk is defined to the entry premium of $222.

The cyan line (Today - 60 DTE) shows the long call’s payoff at trade entry. If the stock makes a big move right away, this line shows the projected profit and loss.

The 30 DTE line shows the payoff halfway to expiration. The profits for a given movement are worse than at trade entry, showing how buying calls is a race against time.

Key Characteristics

- Max Profit: Unlimited

- Max Loss: Total premium paid. Occurs if the stock closes at or below the call strike at expiration.

- Breakeven: Strike price + premium paid.

- Outlook: Bullish

How the Greeks Affect a Long Call

| Greek | Long Call | What It Means |

|---|---|---|

| Delta (Δ) | Positive | Profits when the stock rises |

| Gamma (Γ) | Positive | Delta increases as the stock rises |

| Theta (Θ) | Negative | The position loses value each day |

| Vega (ν) | Positive | Profits when IV rises |

Long calls have positive exposure to stock price and volatility, but negative exposure to the passage of time.

A call buyer profits when the stock price and/or volatility increase enough to offset time decay.

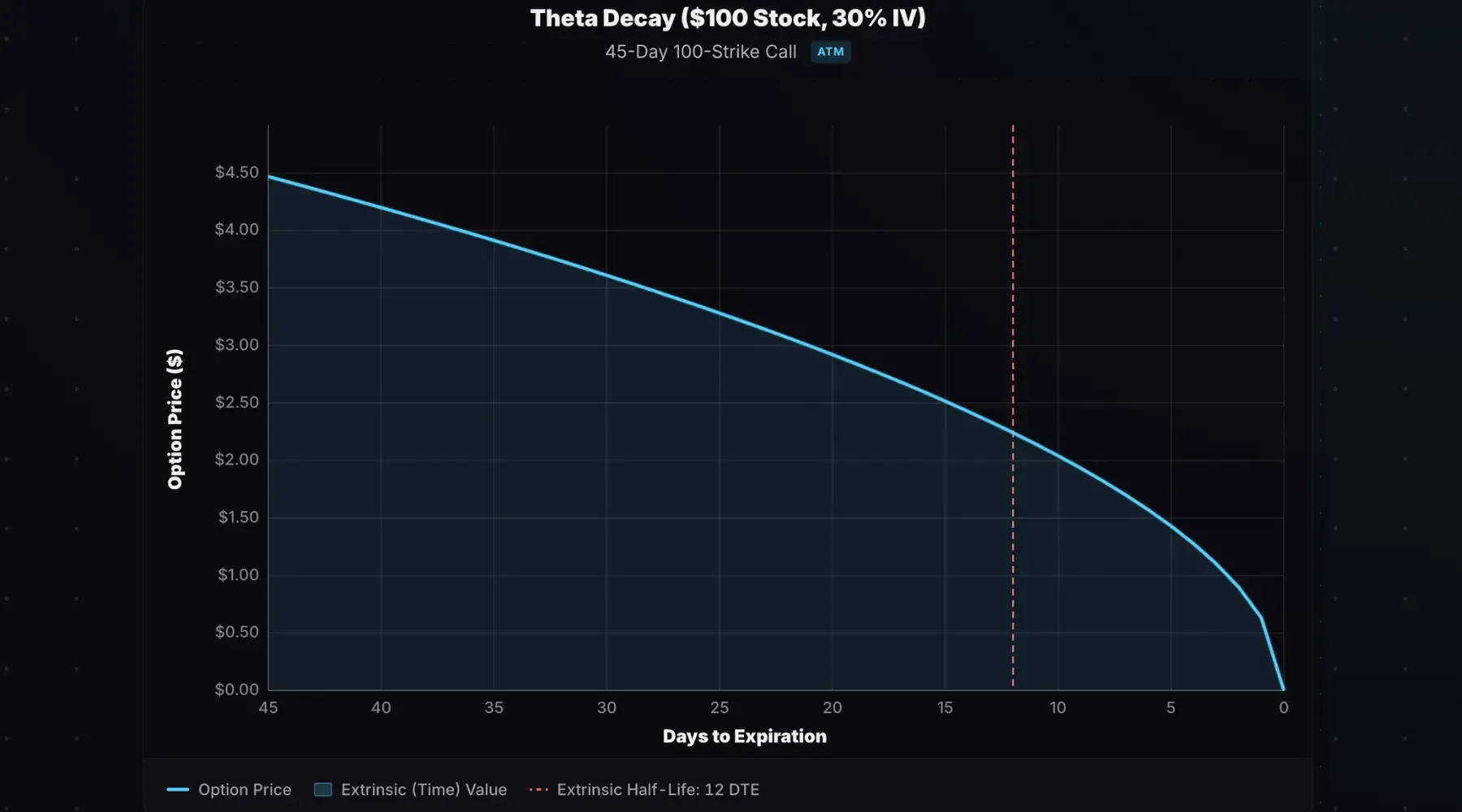

Time Decay

Options lose some of their extrinsic value every day—this is theta decay. The chart below shows how an at-the-money call’s price falls as time passes:

Position: $100 stock, $100 strike, 30% IV, 45 DTE.

The chart assumes no stock price movement or change in implied volatility, which isolates the effect of time decay.

Buying calls has an asymmetric return profile—gains are unlimited while risk is defined. The cost of that return profile is time decay—the daily erosion of the option’s price if the stock doesn’t increase.

Use the theta decay curve calculator to visualize any option’s time decay.

Implied Volatility

Implied volatility (IV) reflects the market’s expectation of future price swings. Rising IV means option prices are increasing as participants price in larger expected movements.

Long calls have positive vega, meaning they increase if implied volatility goes up, and decrease if implied volatility falls. The table below shows how a 1% change in IV affects the call price:

Buying calls is risky when IV is elevated—often after a large move in a short period. If you buy calls and IV collapses, you’ll suffer heavy losses even if the stock price doesn’t move. You can lose money even if the stock moves in your favor if IV collapses.

But if you can time a stock price increase combined with a large IV increase (common on individual stocks making a strong move higher), the call’s value will surge.

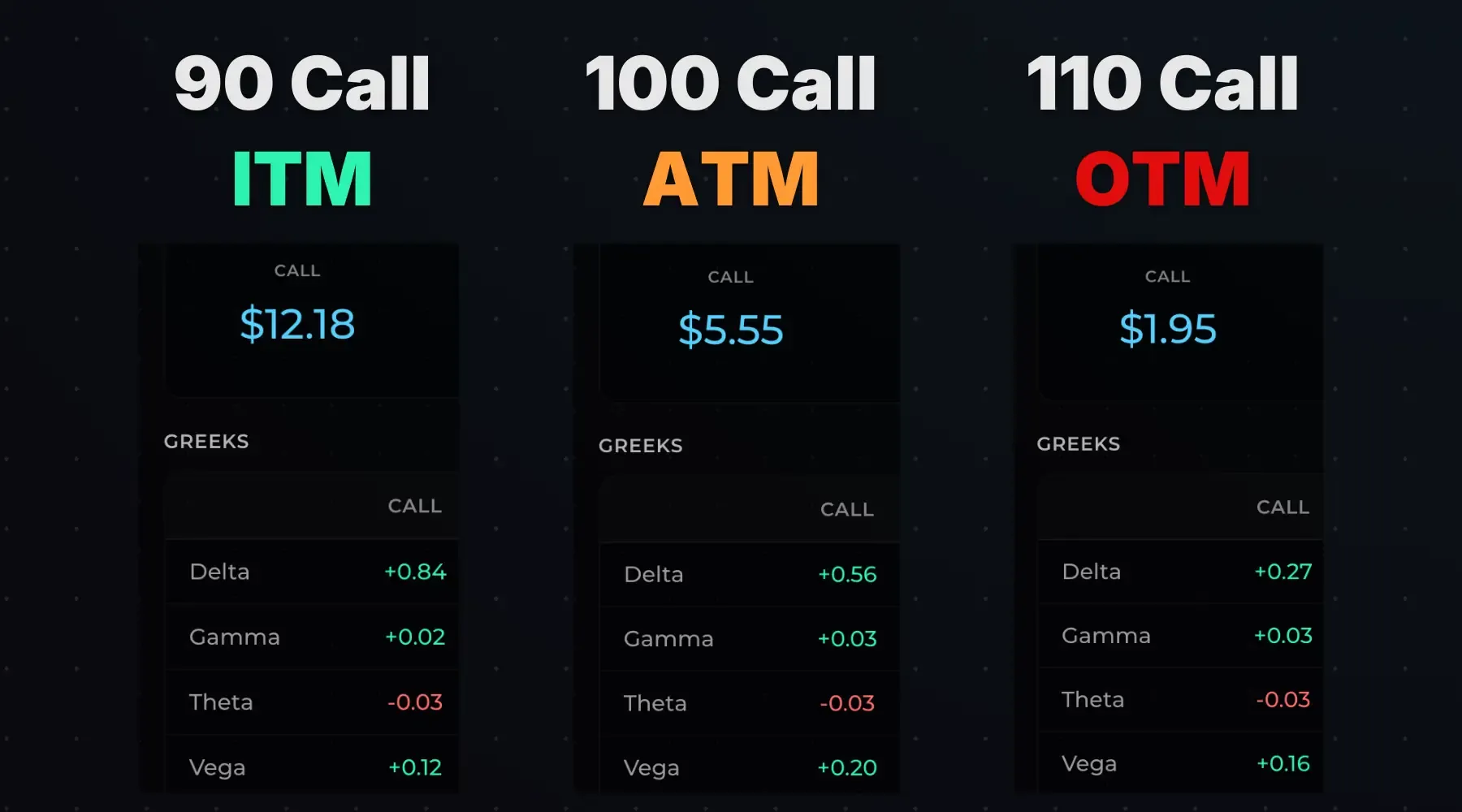

Choosing a Strike

Strike price selection affects cost, leverage, risk/reward, and probability of profit.

Consider a $100 stock with 90-day options and 25% IV:

The ITM call (90 strike) costs more than the ATM or OTM call, but it has $10 of intrinsic value and only $2.18 of extrinsic, plus a high delta. The ATM and OTM calls have pure extrinsic value but cost less.

With $2,500 to spend, you could buy two ITM calls, ~5 ATM calls, or 12 OTM calls.

Since each contract controls 100 shares and can reach a max position delta of +100, your max delta is +200 for ITM, +500 for ATM, and +1,200 for OTM.

This is why aggressive traders favor ATM or OTM options—more leverage for the same capital.

But the cost of buying ATM or OTM options is full exposure to time decay and lower probability of profit compared to ITM.

Choosing an Expiration

Your choice of expiration on a long call trade changes the risk profile.

Short-dated options (< 30 DTE):

- Cheaper in absolute terms

- Faster theta decay—time works against you aggressively

- Require precise timing

- Higher gamma: bigger swings in P/L from small moves

Medium-term options (60+ DTE):

- More expensive

- Slower theta decay—more forgiving if the move takes time

- Higher vega: more sensitive to IV changes

- Less leverage per dollar, but more time to be right

LEAPS (> 1 year):

- Highest cost but slowest decay

- Behaves like leveraged stock, especially for ITM strikes

- Best for long-term directional bets without precise timing

Match the expiration to your outlook. If you’re expecting a large move in the next week, short-dated options provide higher returns than longer-term calls at the same strike, but with less margin for error. If you like a stock for the long-term and want leveraged exposure but aren’t sure of near-term timing, ITM LEAPS provide that.

Long Call vs Stock

Long calls provide significant leverage over buying shares outright.

SOFI trades at $27. You’re bullish and want exposure to 100 shares. You have two choices:

Option A: Buy 100 shares

- Cost: $27 × 100 = $2,700

Option B: Buy an at-the-money call (1 year to expiration)

- $27 strike call priced at $5.00

- Cost: $5.00 × 100 = $500

On a trading platform, you’ll see the option quoted at $5.00. To get the total cost, multiply by 100—this is the contract multiplier, since each option contract represents 100 shares.

Both positions benefit if SOFI rises, but the risk profiles differ:

Stock Entry: $27. Call Strike: $27. Option Cost: $5.00 premium ($500 total cost). Hover to compare P/L at each price.

If SOFI falls to $20: You lose $700 on the shares (−26%) vs $500 on the call (−100%). Bigger dollar loss on the shares, but total wipeout on the call.

If SOFI rises to $40: You make $1,300 on the shares (+48%) vs $800 on the call (+160%). Fewer dollars, but 3x the percentage return. That’s the leverage.

If SOFI rises to $50: You make $2,300 on the shares (+85%) vs $1,800 on the call (+360%).

The call offers superior leverage and capped downside—but the stock must move enough to overcome time decay and exceed the breakeven point at expiration to profit.

Dividends

Owning stock entitles you to dividends. Owning call options does not.

However, if you own an ITM call and the stock has an upcoming ex-dividend date, exercising early to capture the dividend makes sense when the call’s extrinsic value is less than the dividend amount. But you’ll need the cash to buy the shares—if you can’t afford them, you can’t exercise the calls to get the dividend.

Entry, Exit, and Expiration

To enter: Place a buy-to-open (BTO) order. Your buying power is reduced by the call premium immediately.

To exit before expiration: Sell-to-close (STC) to realize your P/L without exercising. Your account is credited with the sale proceeds.

If held through expiration:

- Call OTM (stock ≤ strike): Call expires worthless. Full premium loss.

- Call ITM (stock > strike): The call auto-exercises if ITM by $0.01 or more. You buy 100 shares per contract at the strike price.

Watch your buying power. If you hold 10 contracts of a $30-strike call and the stock is at $40 at expiration, auto-exercise means buying 1,000 shares at $30/share:

$30 × 1,000 = $30,000 required

If you don’t have the capital, close the position before expiration.

- A long call option delivers leveraged bullish exposure with defined risk.

- Max loss = premium paid. Max profit = unlimited. Breakeven = strike + premium.

- OTM calls are cheaper with higher leverage, but lose 100% if the stock stays flat.

- ITM calls cost more with less leverage, but include intrinsic value and have higher probability of profit.

- Theta works against you—the stock must rise fast enough to offset time decay.

- Auto-exercise occurs for calls ITM by $0.01+ at expiration. Ensure you have the cash to buy shares, or close before expiration.

- A long call option delivers leveraged bullish exposure with defined risk.

- Max loss = premium paid. Max profit = unlimited. Breakeven = strike + premium.

- OTM calls are cheaper with higher leverage, but lose 100% if the stock stays flat.

- ITM calls cost more with less leverage, but include intrinsic value and have higher probability of profit.

- Theta works against you—the stock must rise fast enough to offset time decay.

- Auto-exercise occurs for calls ITM by $0.01+ at expiration. Ensure you have the cash to buy shares, or close before expiration.

Related Guides

- What Is a Long Put? — Bearish counterpart to the long call

- Bull Call Spread — Reduce cost by capping upside

- Call vs Put Options — Core differences explained

- What Is Delta? — How option prices change with the stock

- What Is Theta? — Understanding time decay

Ready to visualize your own call trades? Use our Long Call Calculator to model P/L for any long call position.