Iron Condor Options Strategy Explained

How iron condors work, when to trade them, and how to calculate max profit, max loss, and breakevens.

An iron condor is a neutral options strategy that combines a put credit spread and a call credit spread. You sell an OTM put and an OTM call, then buy further OTM options on both sides to cap your risk. The result is a position that profits when the stock stays within a range—with defined risk on both sides.

Iron Condor Example

If a stock is at $200, an iron condor would be:

- Buy one 170 put for $0.35

- Sell one 180 put for $1.26

- Sell one 220 call for $2.29

- Buy one 230 call for $0.99

- Net Credit: $2.21

The iron condor makes money as long as the stock stays between $180 and $220 as time passes. The maximum profit occurs if the stock closes anywhere between $180 and $220 at expiration—all options expire worthless and you keep the full $221 credit.

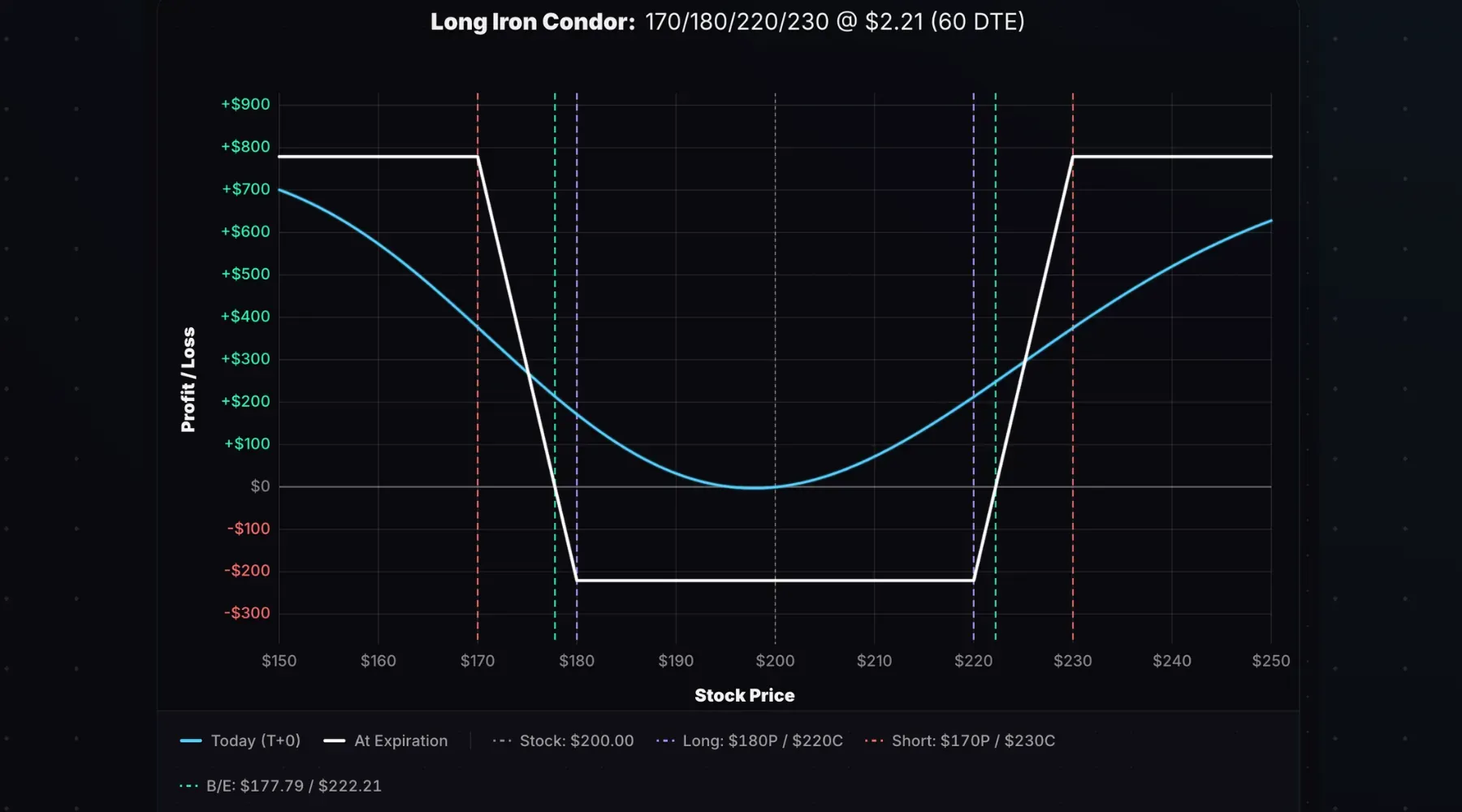

Payoff Diagram

The iron condor payoff is flat between the short strikes and slopes toward max loss beyond them:

Stock at Entry: $200. Trade: 170/180/220/230 iron condor entered for a $2.21 credit. 60 days to expiration (DTE).

The white line shows the payoff at expiration. Maximum profit of $221 spans the entire range between the short strikes ($180–$220). Losses grow as the stock moves beyond the short strikes, capping at $779 beyond either long strike.

The cyan line (T+0) shows the modeled payoff at entry.

The gap between the two represents time decay yet to be captured.

Key Characteristics

- Max Profit: Net credit × 100. Occurs if the stock closes between the short strikes at expiration.

- Max Loss: (Spread width − net credit) × 100. Occurs if the stock closes beyond either long strike.

- Upper Breakeven: Short call strike + net credit

- Lower Breakeven: Short put strike − net credit

- Outlook: Neutral—expecting the stock to stay within a range

Here are the metrics for the 170/180/220/230 iron condor sold for $2.21:

Unlike a short strangle, the iron condor has defined risk—you know your worst-case loss at entry. The margin requirement equals the max loss ($779), compared to $5,000+ for a strangle at the same short strikes. Defined risk also means lower probability of profit, since the long options reduce the credit received.

How the Greeks Affect an Iron Condor

An iron condor has negative gamma, negative vega, and positive theta when the stock is between the short strikes. Delta begins near zero, making the trade market-neutral at entry.

| Greek | Between Short Strikes | What It Means |

|---|---|---|

| Delta (Δ) | Near Zero | Neutral at entry; shifts as the stock moves toward a spread |

| Gamma (Γ) | Negative | Delta shifts against you as the stock moves |

| Theta (Θ) | Positive | Time decay benefits the position |

| Vega (ν) | Negative | Rising IV hurts; falling IV helps |

When the Greeks Flip

If the stock moves beyond either long strike, the Greeks flip:

- Theta turns negative — Time decay works against you

- Vega turns positive — Rising IV now helps (the long option gains more than the short loses)

Compare the T+0 P/L line (payoff at entry) against the Expiration P/L line between the short strikes and beyond the long strikes:

Between the short strikes, the T+0 line sits below the expiration line—positive theta. Time works for you.

Beyond the long strikes, the T+0 line sits above the expiration line—negative theta. Time works against you.

Time Decay Impact

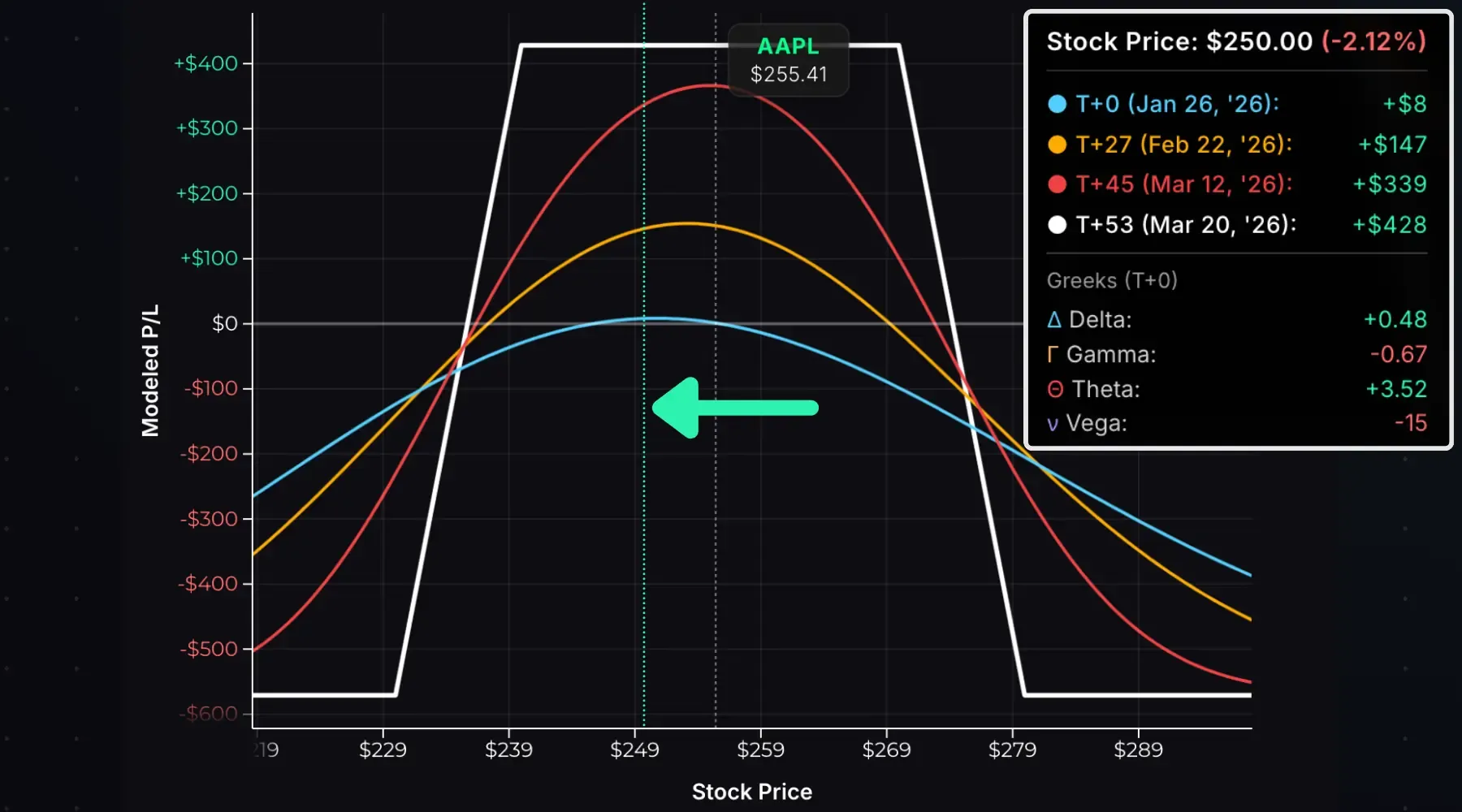

Time decay is the primary profit engine for iron condors. Here’s a 230/240/270/280 iron condor on AAPL entered for a $4.28 credit with 53 DTE:

With the stock at $250 (between the short strikes), here’s how profits grow over time:

| Time | Projected P/L |

|---|---|

| T+27 | +$147 |

| T+45 | +$339 |

| T+53 (Expiration) | +$428 (max) |

The P/L curves show positive theta in action—profits grow as expiration approaches with the stock between the short strikes.

Implied Volatility Impact

Implied volatility directly affects how much credit you collect:

- High IV = Larger credit (same strikes and expiration)

- Low IV = Smaller credit

This is why iron condor traders target elevated IV—you get paid more for the same setup.

After entry, IV changes affect your position:

- IV contraction helps when the stock is in the profit zone. Lower volatility means higher probability of staying in range—the iron condor loses value and the seller profits.

- IV expansion hurts when the stock is in the profit zone. Higher volatility means higher probability of breaking out—the iron condor gains value and the seller loses.

An IV spike can cause unrealized losses even if the stock hasn’t moved. But as long as the stock settles between the short strikes at expiration, all extrinsic value disappears and you keep the full credit.

Strike Selection

Strike selection determines your probability of profit, credit received, and risk/reward tradeoff.

Short Strikes: Start with Delta

Many traders select short strikes based on delta, as its secondary use is an approximation of the probability of that option expiring ITM.

- 16-delta short strikes ≈ 68% probability both expire worthless (one standard deviation)

- 20-delta short strikes ≈ 60% probability both expire worthless

- 30-delta short strikes ≈ 40% probability both expire worthless

Further from the stock = higher probability of profit, but less credit. Closer to the stock = more credit, but lower probability.

Long Strikes: Select Your Wing Width

After selecting short strikes, choose your wing width—the distance to your long strikes.

A common approach: start with 16-delta short strikes and go 10 points out for the long strikes. For a $200 stock, this might be 170/180 put spread and 220/230 call spread.

Wider wings:

- More credit (long options cost less)

- More risk (larger max loss)

- Lower return on capital

Narrower wings:

- Less credit (long options cost more)

- Less risk (smaller max loss)

- Higher return on capital

Skewing Directionally

You don’t have to set up symmetric strikes. Adjusting the short strike deltas lets you express a directional bias.

Bullish Skew: Sell a 20-delta put and 10-delta call. The put spread is closer to the stock, collecting more premium on the downside. You’re giving the stock more room to rally.

Bearish Skew: Sell a 10-delta put and 20-delta call. The call spread is closer to the stock, collecting more premium on the upside. You’re giving the stock more room to fall.

The tradeoff: your position is no longer market-neutral at entry.

Entry, Exit, and Expiration

To enter: Sell the four-leg iron condor as a single order. You’ll receive a net credit.

To exit before expiration: Buy back all four legs in a single order. You’ll pay a debit to close. Profit = credit received − debit paid.

Profit target: Close at 50–75% of max profit. Beyond that, you’re squeezing out small gains while still holding all the risk.

Potential scenarios at expiration, using the 170/180/220/230 iron condor sold for $2.21:

| Stock at Expiration | Result |

|---|---|

| $200 (between strikes) | All options expire worthless. Keep $221 credit. |

| $175 (within put spread) | Put spread partially ITM. Partial loss. |

| $165 (beyond long put) | Put spread at max value ($10). Max loss: $779. |

| $235 (beyond long call) | Call spread at max value ($10). Max loss: $779. |

Expiration Risk

If the stock is near a short strike at expiration, don’t hold through. The stock might settle just beyond your short strike, leaving you with a stock position via assignment.

Example: Your short 220 call expires with the stock at $220.10. You’re assigned short 100 shares—an unlimited-risk position. Unless the stock is safely between the short strikes, close before expiration.

How to Manage an Iron Condor

Rolling the Untested Side

If the stock moves from $200 up toward $220, the put spread shows profits while the call spread shows losses. You can “roll up” the put spread:

- Buy back the 180/170 put spread

- Sell a new 200/190 put spread

This collects additional credit, increasing profit potential and decreasing max loss. The tradeoff: a narrower profit range.

After Rolling (assuming $1.00 additional credit):

| Metric | Before Roll | After Roll |

|---|---|---|

| Net Credit | $2.21 | $3.21 |

| Max Profit | $221 | $321 |

| Max Loss | $779 | $679 |

| Return on Risk | 28.4% | 47.3% |

The position now leans bearish—the T+0 line rises as the stock falls back into the profit zone.

Ideal Conditions for Selling Iron Condors

Sell iron condors when:

- You expect range-bound price action in the underlying

- Implied volatility is elevated (IV percentile > 50%)—you collect a larger credit, or can place strikes further from the stock for similar premium

- There are no major catalysts like earnings before expiration

If IV contracts after entry while the stock stays in range, you benefit from both theta and vega.

Iron Condor vs. Iron Butterfly

The iron condor and iron butterfly both combine a put spread and call spread. The difference: strike placement.

| Feature | Iron Condor | Iron Butterfly |

|---|---|---|

| Short Strikes | Different (OTM put and OTM call) | Same strike (ATM) |

| Profit Zone | Wide | Narrow—stock must stay near the short strike |

| Credit Received | Smaller | Larger |

| Max Profit | Lower | Higher |

| Max Loss | Higher | Lower |

| Probability of Profit | Higher | Lower |

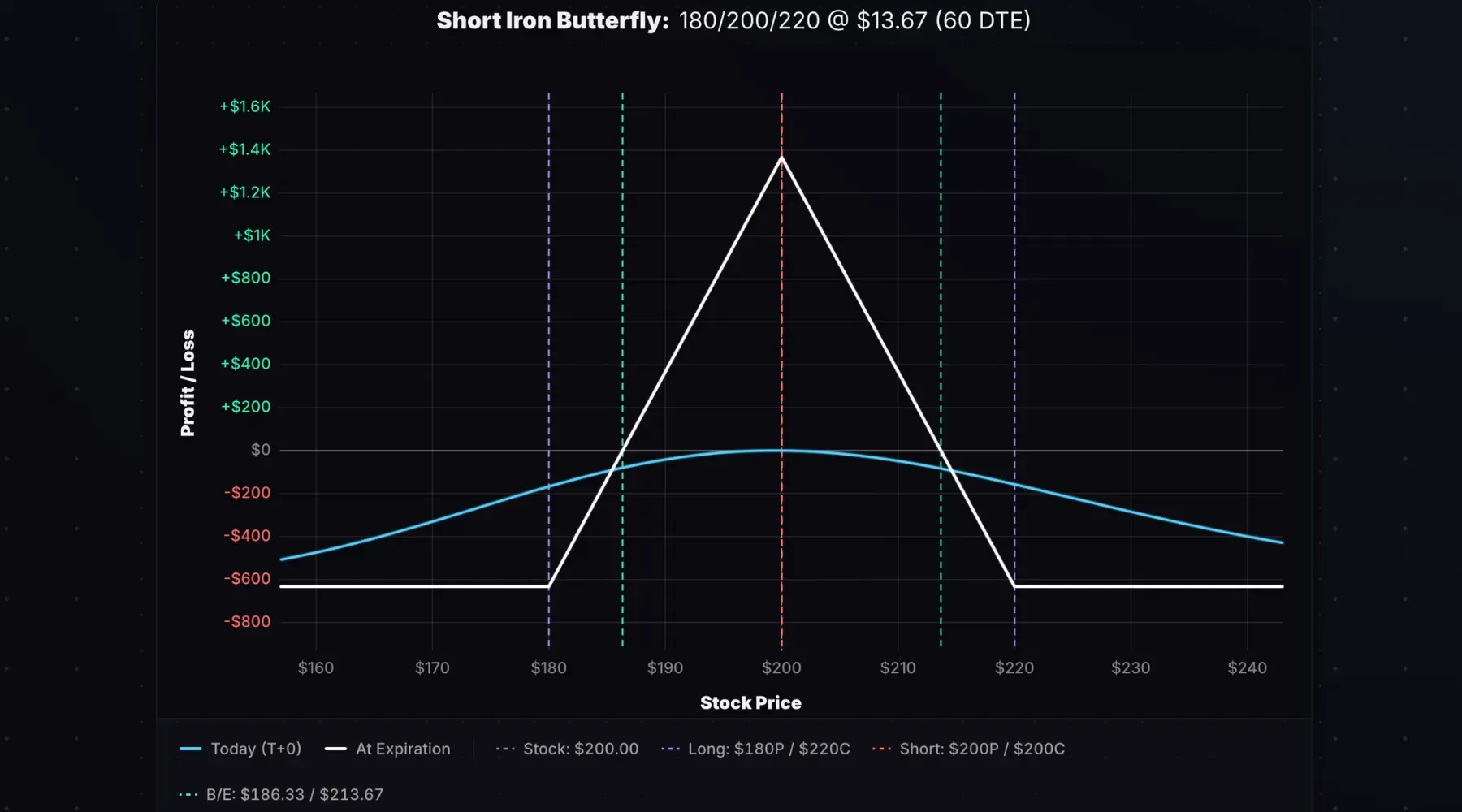

Iron Butterfly Example

An iron butterfly sells a 200 put and 200 call (same strike), then buys a 180 put and 220 call:

With 60 DTE and 25% IV, this iron butterfly collects $12.61:

The iron butterfly offers larger credit and higher profit potential, but with much lower probability of profit. Max profit only occurs if the stock lands exactly at the short strike—highly unlikely. More realistic targets are 25–50% of max profit.

Iron Condor vs. Short Strangle

A short strangle is an iron condor without the protective long options—unlimited loss potential.

| Feature | Iron Condor | Short Strangle |

|---|---|---|

| Long Options | Yes (defines risk) | No |

| Maximum Risk | Limited | Unlimited |

| Premium Collected | Lower | Higher |

| Margin Requirement | Lower (equals max loss) | Much higher (5–10× credit) |

Assuming the same short strikes, a short strangle collects more premium since no options are purchased. But the tradeoff is unlimited upside risk and substantial downside risk.

In most cases, paying a small premium to buy protective wings is worth removing catastrophic risk.

Long Iron Condor

The long iron condor is the inverse—you buy the inner strikes and sell the outer strikes, paying a net debit. It profits when the stock makes a big move in either direction.

The long iron condor has positive asymmetry—profit potential exceeds loss potential. But it’s a low-probability trade with negative theta. You lose money each day the stock doesn’t move. Long iron condors are rarely traded.

- Iron condors profit when the underlying stays within a defined range through expiration.

- The strategy combines a bull put spread and bear call spread, collecting a net credit with defined risk.

- Max profit = net credit. Max loss = spread width minus net credit.

- The Greeks flip beyond the long strikes—theta turns negative and time works against you.

- Select short strikes by delta (16-delta ≈ 68% probability of expiring OTM), then choose wing width based on risk tolerance.

- Iron condors profit when the underlying stays within a defined range through expiration.

- The strategy combines a bull put spread and bear call spread, collecting a net credit with defined risk.

- Max profit = net credit. Max loss = spread width minus net credit.

- The Greeks flip beyond the long strikes—theta turns negative and time works against you.

- Select short strikes by delta (16-delta ≈ 68% probability of expiring OTM), then choose wing width based on risk tolerance.

Related Guides

- What Is a Short Strangle? — Similar payoff, but with undefined risk

- What Is a Short Straddle? — Sell ATM options for maximum premium

- What Is Theta? — Understanding time decay

- What Is Implied Volatility? — The key input driving iron condor pricing

Ready to analyze your own trades? Use the Iron Condor Calculator to visualize P/L and see how different strikes, IVs, and expirations affect the trade.