What Is a Cash-Secured Put?

How cash-secured puts work, with example trades, payoff diagrams, breakeven calculations, and when to sell them.

A cash-secured put is an options strategy where you sell a put option while holding enough cash in your account to buy the underlying stock if assigned. This conservative options strategy allows you to collect premiums while waiting to acquire shares at a lower price.

The beauty of this strategy is that most outcomes work in your favor.

If the stock price stays above the put strike, you keep the premium as profit. If the stock price falls below the put at expiration, you use your cash to buy the shares at the put’s strike price, getting a much lower entry price on the shares than buying stock outright when selling the put.

Let’s explore the strategy in-depth with lots of detailed examples and visuals.

How Cash-Secured Puts Work

A cash-secured put is a short put position with cash set aside as collateral.

When you sell a put option, you’re agreeing to buy 100 shares at the put’s strike price if the option is exercised. But for the put to be cash-secured, you need to keep cash as collateral to cover the cost of the shares.

Example: You sell a put with a strike of $150. To buy 100 shares of a $150 stock, you need $15,000. For this put to be cash-secured, you need to set aside $15,000 in cash as collateral to buy the stock if you get assigned.

Cash-Secured Put Example

Let’s walk through a concrete example using a $180 stock with a $170 strike put trading for $7.77. The put has 60 days to expiration (DTE).

To initiate a cash-secured put, you would sell the 170 put for $7.77, collecting $777 in total premium (the option’s price multiplied by 100 shares). Selling the 170 put obligates you to buy 100 shares at $170 if assigned—which happens if the stock is below $170 at expiration.

Here are the key profitability metrics for this cash-secured put position:

You need $17,000 to buy 100 shares, so you’d need to keep $17,000 in cash as collateral when selling this put.

The maximum profit is $777, representing a 4.57% return on the cash set aside if the put expires worthless.

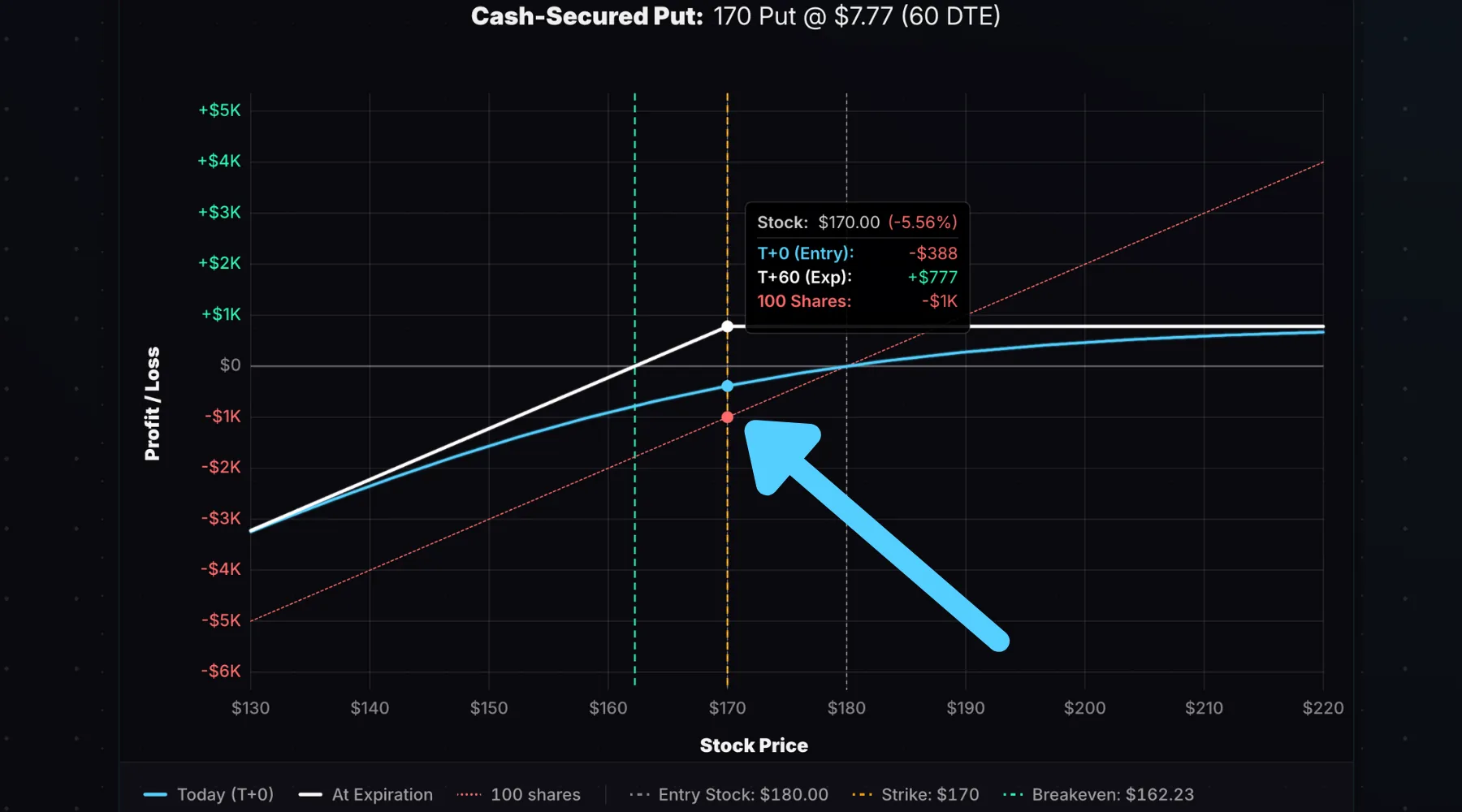

Cash-Secured Put Payoff Diagram

The chart below shows the potential payoff for this cash-secured put position:

Hover over the chart to see specific P/L values for this trade at various stock prices and points in time. The Today P/L line shows the modeled P/L vs. stock price changes on the same day as trade entry.

The 30 DTE line shows the P/L after 30 days have passed, or halfway to expiration.

The Expiration P/L line shows the final profit or loss of the position on the put’s expiration date (60 days from entry).

At any share price at or above $170 at expiration, the put will expire worthless, and the trader will make $777 (the maximum profit potential).

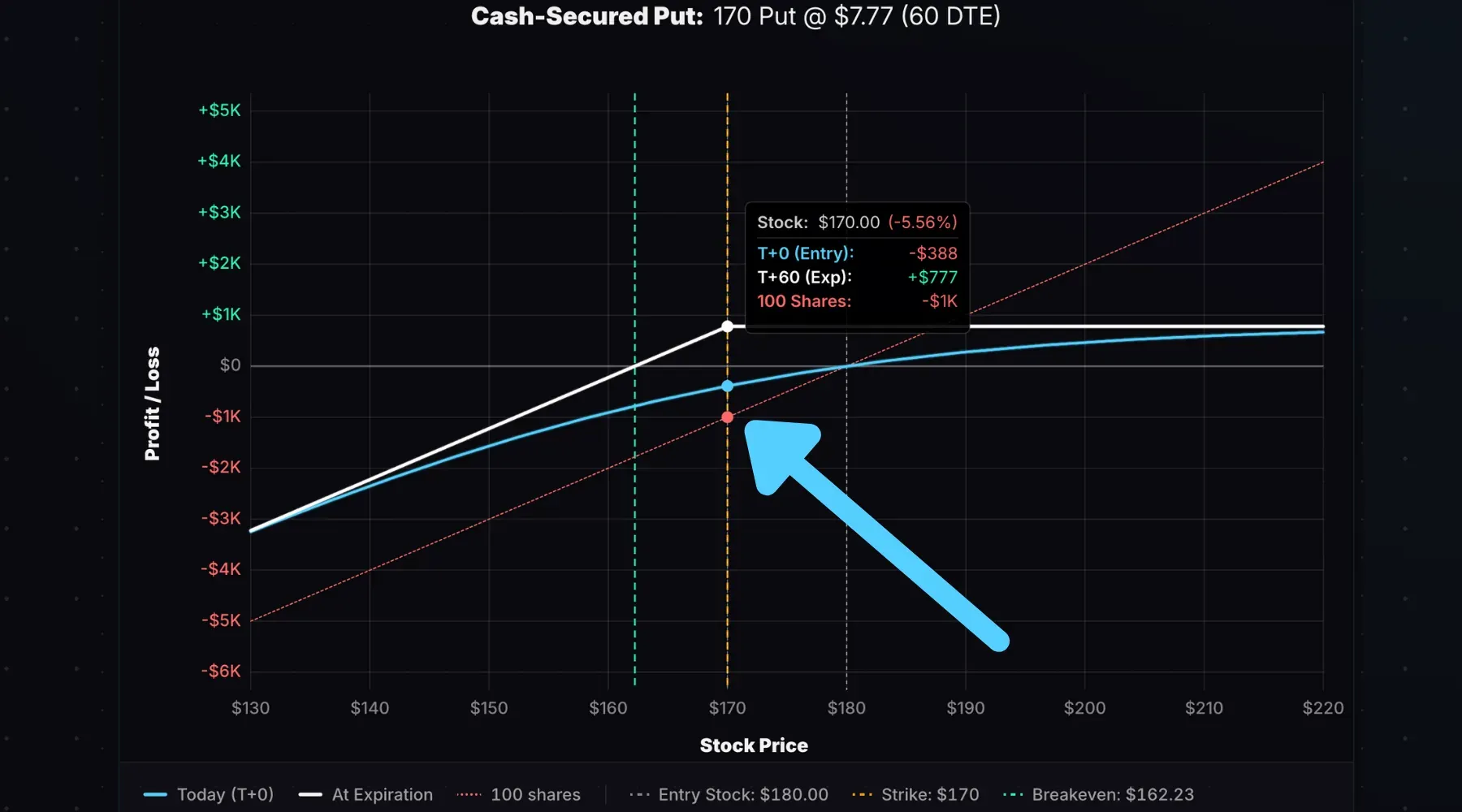

Cash-Secured Put vs Stock

How does the cash-secured put strategy perform vs. buying stock outright?

In the chart above, the “100 Shares” line shows the P/L of an outright stock purchase at $180 from the previous example. Notice how if the stock price falls to the short put’s strike price of $170, the shares will have a loss of $1,000, while the cash-secured put will have the maximum profit of $777 at expiration.

The chart shows that a cash-secured put will outperform buying stock if the share price falls during the trade.

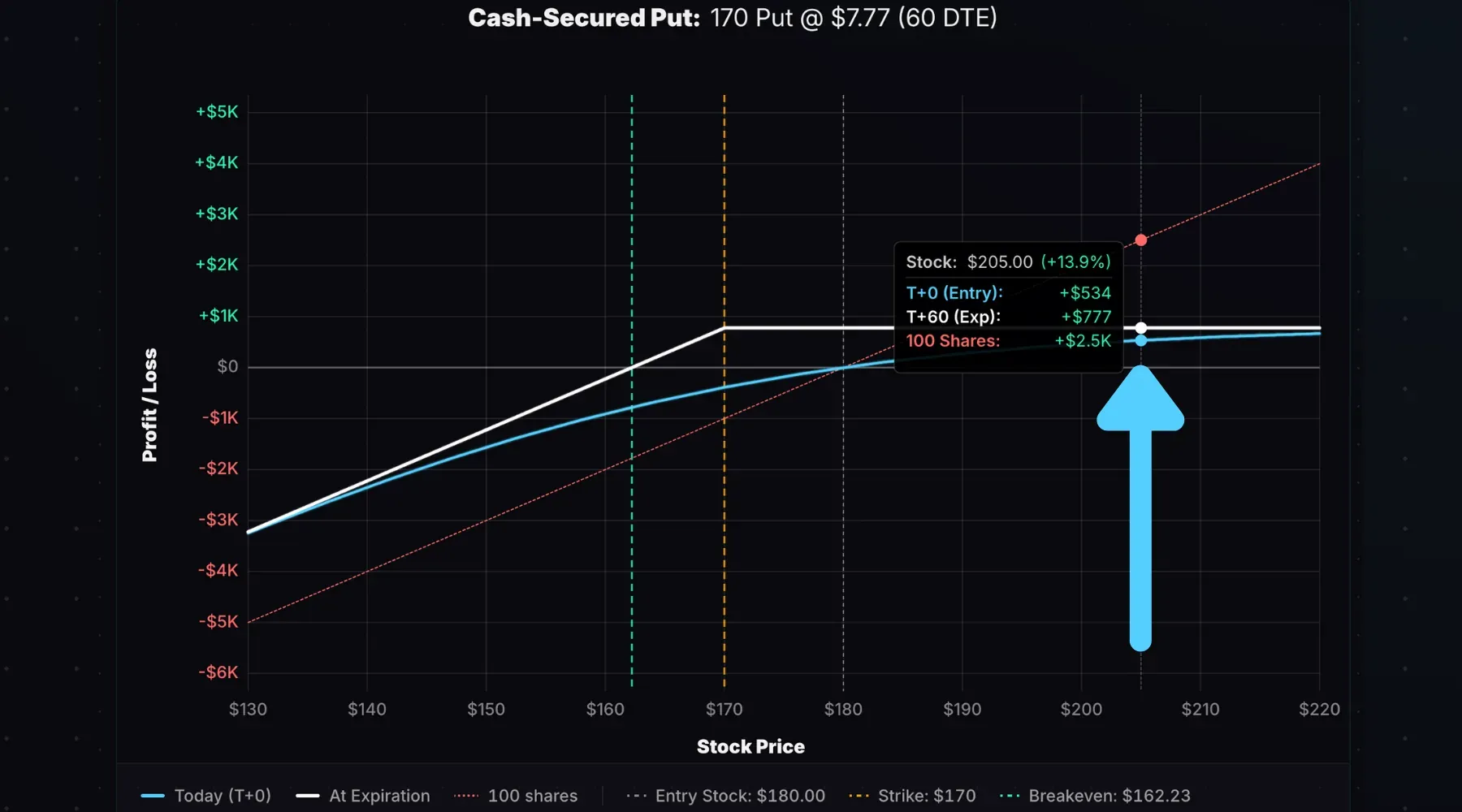

The only way the stock can outperform is if it rises moderately. If the shares rose to $205 (+13.9%) during the trade, the 100 shares would have a profit of $2,500 vs. the cash-secured put’s profit of $777:

Both positions make money, but the outright stock purchase outperforms since it has unlimited profit potential, while selling puts has capped profit potential.

Maximum Profit and Maximum Loss

Maximum Profit: Limited to the total premium received ($777 in our example). This is the entry put price × 100. A listed option price of $7.77 needs to be multiplied by 100 to get its dollar value, since each option represents 100 shares.

The maximum profit is achieved when the stock price is at or above the put’s strike at expiration because the put will expire worthless. If you sell an option for $777 in premium and it goes to $0, you keep the entire difference.

Maximum Loss: Strike price minus premium received, multiplied by 100. If the stock went to $0, the maximum loss would be ($170 - $7.77) × 100 = $16,223.

How to Calculate the Breakeven Price

The expiration breakeven price for a cash-secured put equals the strike price minus the premium received.

In our example, the breakeven price is $170 - $7.77 = $162.23.

That’s because if the stock price is $162.23 at expiration, the 170 put will have $7.77 of intrinsic value, which is the same as the sale price.

When to Sell Cash-Secured Puts

Cash-secured puts work best when you’re bullish on a stock and would be happy to own shares at the strike price. But you’re not expecting a significant rally in the near-term (otherwise you’d buy stock or use an options strategy with more profit potential). High implied volatility environments offer richer premiums to collect, but come with more volatile stock price action.

Cash-secured puts might also be part of a dual-portfolio strategy where you already own the stock, but want to implement an income-generating strategy that can acquire more stock at a lower price, while generating income during stagnant periods where the stock doesn’t do much.

Strike Price Selection

How do you select a strike price when selling puts?

The closer the put strike is to at-the-money (ATM), the more premium you’ll collect, giving you more profit potential. The further out-of-the-money (OTM) the strike price, the less premium you’ll collect, giving you less profit potential.

Let’s compare these two cash-secured puts on a $250 stock with 60 days to expiration and 30% implied volatility:

Selling the ATM put has more profit potential, but more downside risk and a higher probability of getting assigned since the stock price falling one penny results in an ITM put option.

Selling the OTM put has less profit potential, but less downside risk and a lower probability of getting assigned since the shares can fall 4% before dipping below the strike.

Selling ATM puts is more aggressively bullish, while selling OTM puts is conservatively bullish.

Cash-Secured Put vs. Naked Short Puts

Both strategies involve selling puts, but cash-secured puts require holding the cash necessary to buy the full stock position should you be assigned on the puts you sell.

Naked short puts are more speculative—a sharp drop may force you to close for a loss rather than take assignment and wait for a recovery.

Example: NVDA is trading at $183. I can sell a put with a $180 strike price with a margin requirement of only $5,000. Buying 100 shares of stock at $180 requires $18,000 in cash. If I short this put with only the $5,000 margin requirement, I don’t have the cash to buy the shares if assigned. Should the stock price fall dramatically, I could be forced to close the put for a loss, in which case I won’t have any shares in my account to profit from a recovery.

Cash-Secured Put vs. Covered Call

Cash-secured puts and covered calls are complementary strategies. CSPs help you acquire stock at a discount, while covered calls generate income on shares you already own.

With a CSP, you’re getting paid while waiting to buy shares at a lower price. With covered calls, you’re getting paid while waiting to sell shares at a higher price.

Cash-Secured Puts & the Wheel Strategy

The cash-secured put is the entry point for the popular wheel strategy.

The wheel consists of selling put options until assigned. Once you own the shares, you start selling covered calls until assigned. Once assigned on the covered calls, you’re back to the starting position, and you start selling cash-secured puts once more.

How to Manage a Cash-Secured Put

Typically, cash-secured puts aren’t managed since the foundation of the strategy is accepting assignment and buying the stock if the shares fall.

However, if the stock price rallies quickly after entry and you achieve a high percentage of the maximum profit early in the trade, it makes sense to buy back the short put to close the trade for a profit. That way, if the stock falls again, you’ll have taken a profit and can sell a put again at a higher price than before the reversal. You’ll be getting ahead P/L-wise compared to holding the put through the rally and subsequent reversal.

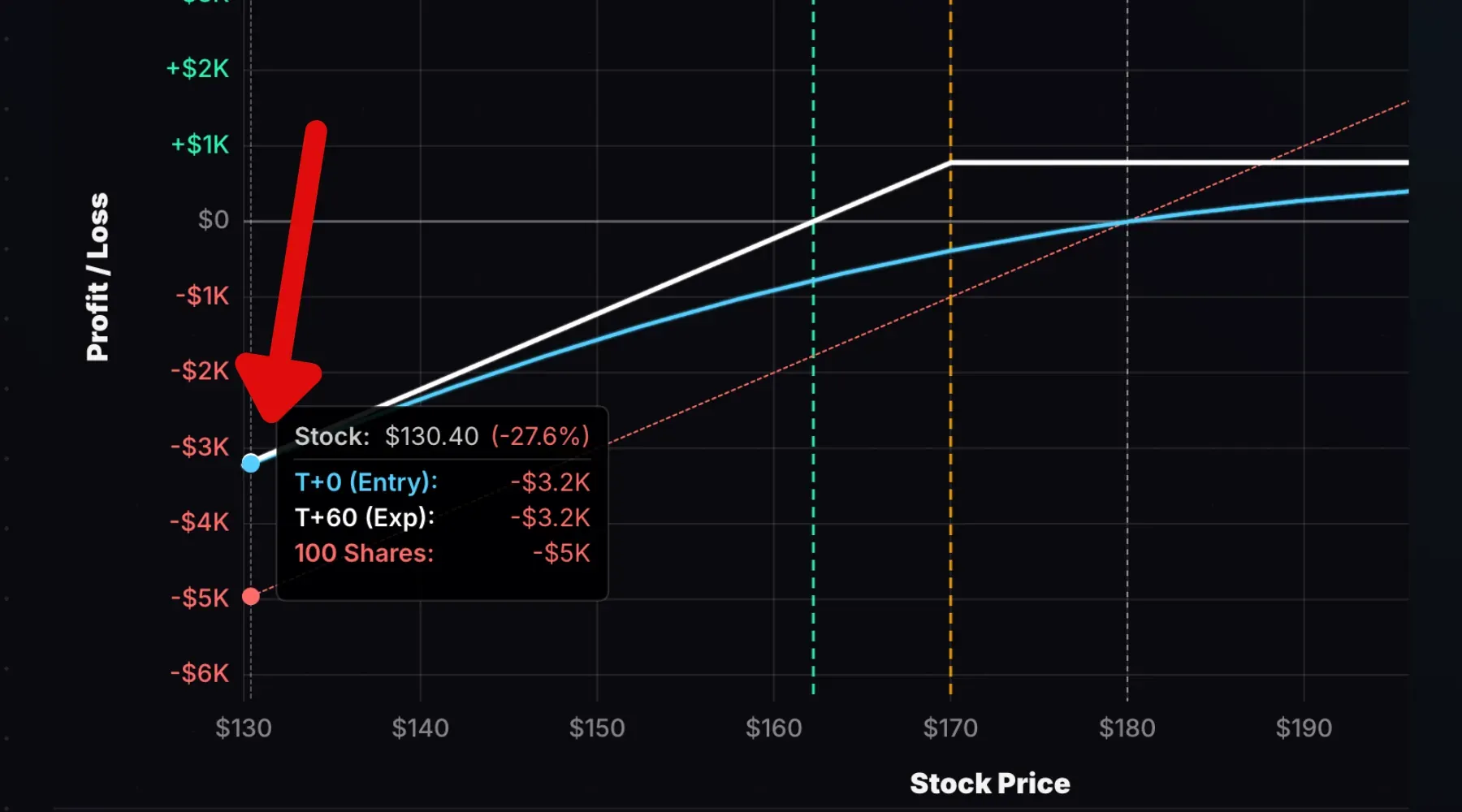

Risks of Selling Cash-Secured Puts

The primary risk when selling puts is a catastrophic collapse in the stock price. When you sell puts, you have stock-like exposure on the downside, but with a cushion:

The payoff diagram above shows the P/L of the 170-strike short put sold when the stock price was $180. The premium collected from the put cushions the downside loss vs. outright stock ownership.

Maximum Loss on Shares: $180 x 100 shares = $18,000.

Maximum Loss on 170 Put: ($170 Strike - $7.77 Credit) x 100 = $16,223.

So if the stock goes to zero during the trade, both positions lose a lot of money, but the CSP outperforms due to the strike price being lower than the entry stock price in addition to the premium received for selling that put.

Early Assignment

Short put positions can be assigned before expiration. It typically happens when the put is deep in-the-money with little extrinsic value. This means the put is extremely deep ITM with lots of time until expiration, or ITM with little time to expiration.

If you’re assigned early, you’ll simply buy 100 shares at the strike price—exactly what you were prepared to do anyway. That’s the point of keeping the cash secured. Unlike some strategies where early assignment creates headaches, here it just accelerates the transition into stock ownership.

The Bottom Line

Selling cash-secured puts lets you get paid while waiting to buy a stock you want to own. If the stock is above your put strike at expiration, the put expires worthless and you keep the full premium received at entry.

If it falls, you buy shares at a discount to the original stock price. Either outcome is acceptable if you’ve chosen a stock you’re happy to hold.

The main risk is a sharp decline—you have full downside exposure below the strike, but we’ve already covered how a CSP has less risk than just buying 100 shares at the time of entering the CSP. I love this strategy because it has a high probability of profit, carries less risk than buying 100 shares, and most outcomes are welcomed.

Use our cash-secured put calculator to visualize P/L for any CSP position.