Options Trading, Explained Simply

A beginner's guide to understanding options contracts, basic terminology, and how to start trading options.

Options trading has a reputation for being complicated. It’s not—there’s just some upfront vocabulary to learn. Once you get familiar with the foundational terms and study a few examples, it comes together quickly.

Let’s break down the top concepts and terminology you’ll encounter.

What Is an Option?

An option is a financial contract. It gives you the right—but not the obligation—to buy or sell a stock at a set price before a certain date.

You pay a small fee upfront (called the premium) for this right. If things go your way, you can make money. If they don’t, you lose what you paid—nothing more.

Defined risk is a huge benefit of option-buying vs. stock. Buying/selling stock can come with lots of downside exposure that options can be used to mitigate. Options allow you to craft strategies that give you less downside risk than owning stock outright, with the potential for large returns if you’re right.

The Two Types of Options

Call Options — Betting the Price Goes Up

A call gives you the right to buy a stock at a specific price.

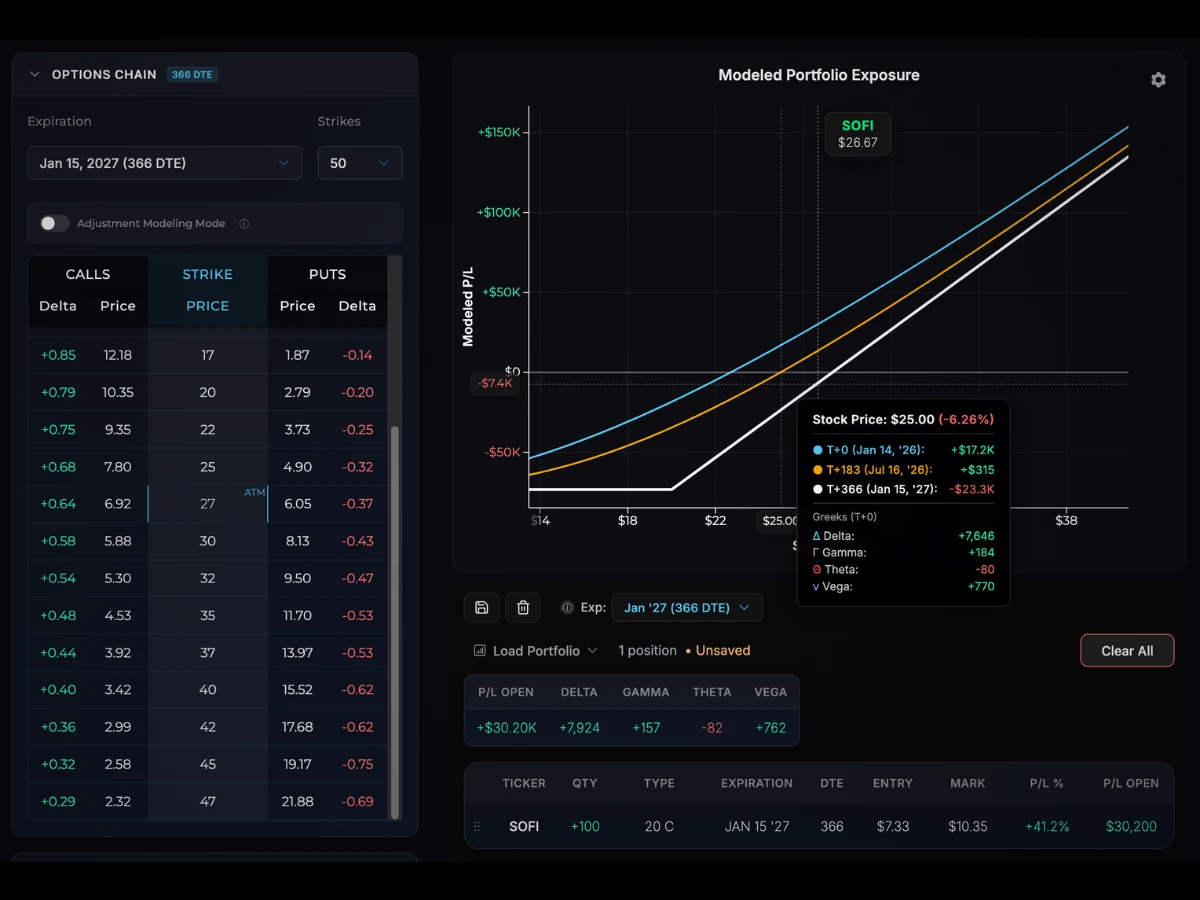

Example: SOFI is trading at $30. You buy a $30 strike call for $2.

Key Lesson: option prices are quoted per share, but each contract controls 100 shares. So a “$2 call” actually costs $200 ($2 x 100).

- If SOFI rises to $35, your call is worth at least $5 per share, or $500 total. You paid $200, so your profit is $300 (150% return).

- If SOFI stays at or below $30 through expiration, your call expires worthless. You lose the $200 you paid.

The chart below shows the risk and return profile of this trade compared to just buying stock. This is the payoff at expiration—hover to see exact values:

Stock Entry: $30. Call Strike: $30. Call Price: $2 ($200 total premium per contract)

Notice how the call limits your downside—you can only lose $200, while the stock position could lose much more if SOFI drops hard. On the upside, the call’s percentage gains dwarf the stock’s.

The tradeoff: returns are magnified in both directions. If SOFI drops 10%, you might lose 50%+ on the call. The dollar risk is smaller, but the percentage swings are larger.

Put Options — Betting the Price Goes Down

A put gives you the right to sell a stock at a specific price.

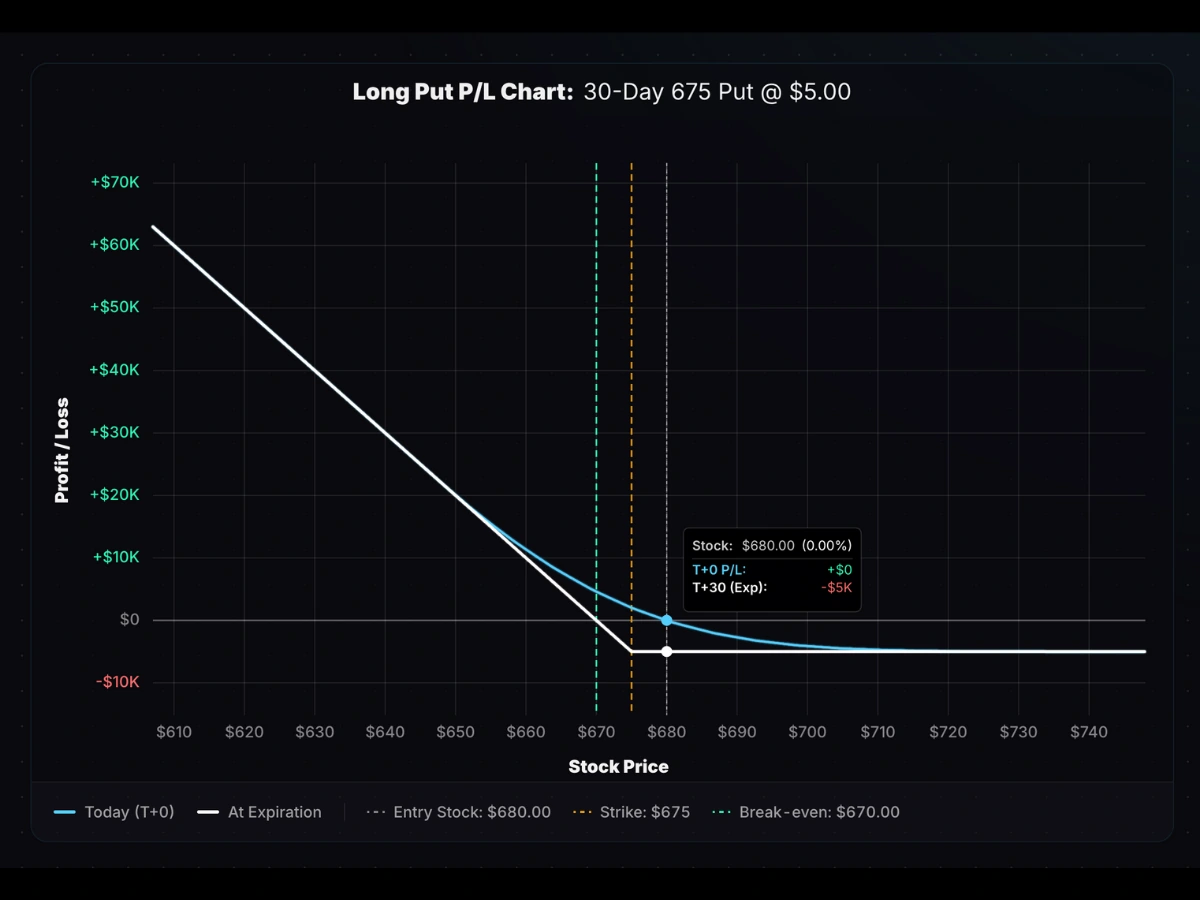

Example: SPY is at $680. You buy a put with a $675 strike for $5.

- If SPY drops to $650, your put is worth at least $25. Your profit would be $20 per contract, or 400% of your initial investment.

- If SPY stays above $675 through expiration, you lose the $5 you paid for the put.

For a deeper dive with interactive P/L charts, see our call vs put options guide.

Key Terms

Strike Price — The price you can buy (call) or sell (put) the stock at.

Premium — What you pay for the option. This is your max loss when buying options.

Expiration Date — Options have a lifespan. After the expiration date, the contract stops trading and settles at its final value.

In the Money (ITM) — The option has real value right now. A $100 call is ITM if the stock is at $110. The call can buy shares at $100 vs. the stock’s price of $110—that’s valuable.

Out of the Money (OTM) — The option has no immediate value. A $100 call is OTM if the stock is at $90. Traders would rather buy stock at $90 than buy it at $100 using the call. But just because it’s OTM now, it doesn’t mean it will remain that way if the stock rallies.

At the Money (ATM) — The strike price roughly equals the current stock price. If the stock price is $244.70, the ATM strike price would be $245.

The Greeks (Just the Basics)

The Greeks measure how an option’s price changes. They’re your position’s risk measurements. Each one shows your exposure to a different variable. Here’s a quick overview:

Delta — How much your option moves when the stock moves $1. A delta of 0.50 means your option moves ~$0.50 if the stock changes by $1.

Gamma — How fast delta changes. More relevant for advanced strategies. Read up on gamma here.

Theta — Time decay. Options lose value every day as expiration approaches. This is the cost of waiting. ATM/OTM options have pure time decay exposure, while ITM options are more sheltered from time decay. Visualize this with our theta decay calculator.

Vega — Sensitivity to volatility. When the market gets choppy, options get more expensive. Vega measures that.

How to Get Started

- Take your time with education first. Don’t make any real trades until you’ve spent a lot of time getting familiar with the concepts and common strategies.

- Paper trade first. Practice with fake money until you’re comfortable (if you have access to a paper trading account).

- Stick to simple trades. Buy a single call or put. Don’t jump into spreads yet. Avoid shorting naked options.

- Use tools to visualize your trades. Visualize the potential profit/loss before you enter any trade. Try our call option calculator or put option calculator. Mess with the inputs to see how the metrics change.

- Start small. Risk only what you’re comfortable losing completely.

One Last Thing

Options can lose 100% of their value, and quickly sometimes. The flip side is that your loss is capped at what you paid, and buying options can actually be safer than trading stock in certain cases.

Start slow, stay curious, and use the tools here to visualize and model trades before you make them.