Long Call Options Strategy Explained

Learn how buying call options works, when to use a long call strategy, and how to calculate max profit, max loss, and breakeven.

A long call involves buying a call option, which grants you the right (but not the obligation) to purchase 100 shares of the underlying stock at a predetermined strike price on or before expiration. This strategy provides leveraged upside exposure while limiting your risk to the premium paid.

Let’s see how it works.

Long Call vs. Buying Stock

SOFI trades at $27. You’re bullish and want exposure to 100 shares. You have two choices:

Option A: Buy 100 shares

- Cost: $27 × 100 = $2,700

Option B: Buy an at-the-money call (1 year to expiration)

- $27 strike call priced at $5.00

- Cost: $5.00 × 100 = $500

On a trading platform, you’ll see the option quoted at $5.00. To get the total cost, multiply by 100—this is called the contract multiplier, since each option contract represents 100 shares.

Both positions benefit if SOFI rises, but the risk profiles differ dramatically. Hover over the chart to compare the P/L at expiration:

Stock Entry: $27. Call Strike: $27. Option Cost: $5.00 premium ($500 total cost). Hover to compare P/L at each price.

If SOFI falls to $20: You lose $700 on the shares (−26%) vs. $500 on the call (−100%). Bigger dollar loss on shares, but total wipeout on the call.

If SOFI rises to $40: You make $1,300 on the shares (+48%) vs. $800 on the call (+160%). Fewer dollars, but 3x the percentage return. That’s leverage.

If SOFI rises to $50: You make $2,300 on the shares (+85%) vs. $1,800 on the call (+360%).

The call offers superior leverage and capped downside—but the stock must move enough to overcome time decay and exceed the position’s breakeven point at expiration to profit.

Long Call Payoff at Expiration

Every long call has the same payoff structure:

- Max loss: 100% of premium (if stock ≤ strike at expiration)

- Max profit: Unlimited (as stock rises)

- Breakeven: Strike + premium

The payoff diagram is a “hockey stick”: flat loss below the strike, then rising linearly above breakeven.

Stock Entry: $100. Call Strike: $100. Option Cost: $15.00 premium ($1,500 total). Breakeven at $115.

Want to calculate your own long call metrics? Try our Long Call Option Calculator to visualize the P/L and see key metrics for any long call option inputs.

Time Decay: The Hidden Cost

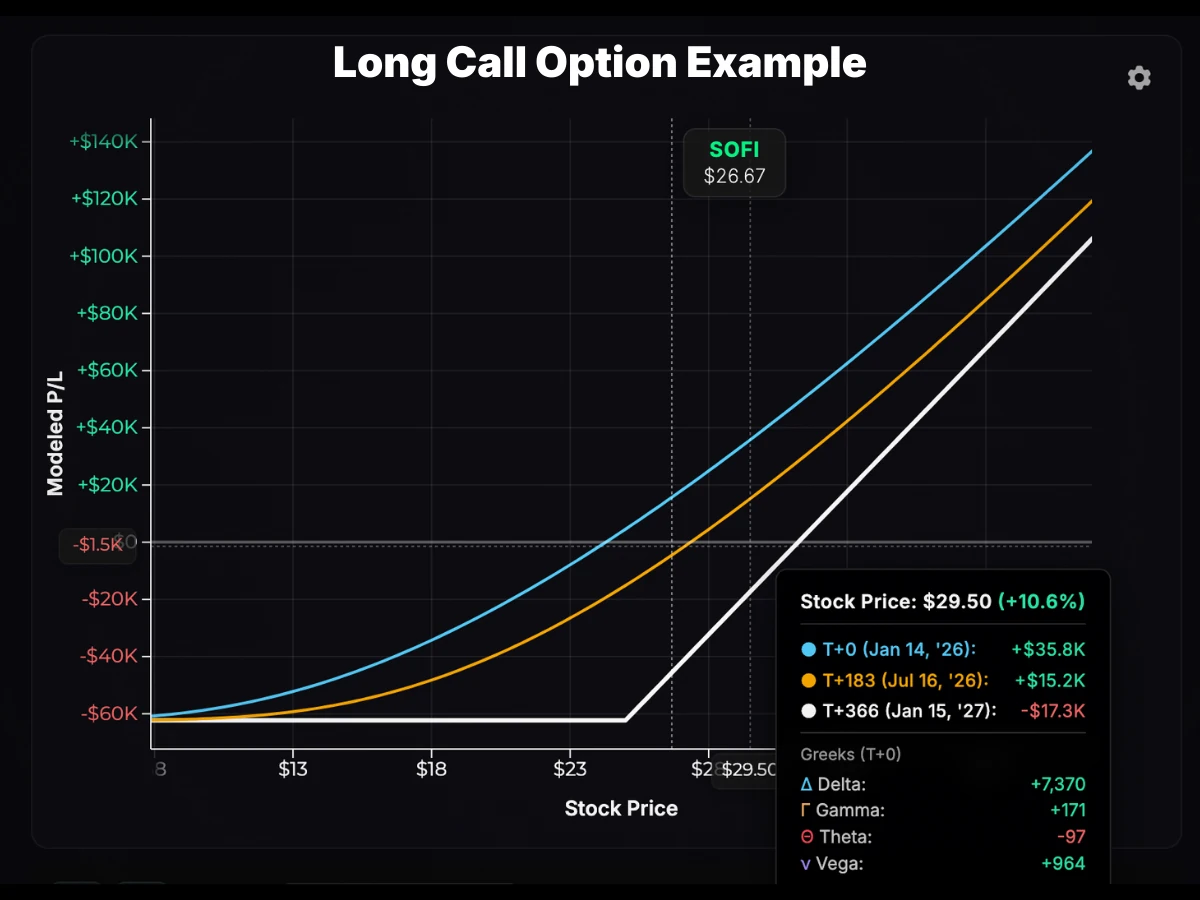

There’s a catch. Options lose value every day—this is called theta decay. The chart below shows how a long call’s P/L changes as time passes.

Position: $50 stock, $50 strike, 30% IV, 60 DTE, $2.62 entry price. Hover to see P/L at each price point and time.

Notice how the T+0 curve (cyan) is flat at the entry price, while the curves further in time show losses at that same price. Even if the stock doesn’t move, your call loses value. The stock must rise fast enough to offset this decay—otherwise you lose money even if you’re directionally correct.

This is why 0 DTE options are extremely risky. They decay by the minute. If you buy a 0 DTE call and the stock stays flat for 30 minutes, you’ll be down money. If the stock moves slightly against you, you can lose a majority of your call’s value.

Use the theta decay curve calculator to visualize how an option’s price erodes over time at a fixed stock price.

When to Use a Long Call

Given the leverage and the time decay risk, long calls work best when you:

- Are bullish and expect a significant move higher within a specific timeframe

- Want to express conviction with leverage

- Want to limit risk to a known amount (the premium)

- Are positioning ahead of catalysts (earnings, product launches, sector tailwinds)

Avoid short-dated options unless your timing conviction is high.

OTM vs. ITM Calls

Not all calls are created equal. You can buy calls that are out-of-the-money (OTM) or in-the-money (ITM), and the trade-offs matter.

Out-of-the-money (OTM) calls have strikes above the current stock price.

- Cheaper (all extrinsic value, no intrinsic value)

- Higher leverage and potential % returns

- Lower probability of profit (needs a larger move)

- More sensitive to time decay

In-the-money (ITM) calls have strikes below the current stock price.

- More expensive (intrinsic + extrinsic value)

- Higher delta (moves closer to 1:1 with stock)

- Higher probability of profit

- Behaves more like leveraged stock

Both lose extrinsic value over time. At expiration, only intrinsic value remains. Since an ITM call starts with intrinsic value, it has less to lose if the stock stays flat—the intrinsic portion is protected.

OTM Call Example

SOFI trades at $27. You buy a $30 strike call (1 year out) for $3.50 ($350 total).

| Metric | Calculation | Value |

|---|---|---|

| Max loss | Premium paid | $350 |

| Breakeven at expiration | Strike + premium = $30 + $3.50 | $33.50 |

| Required move to break even | ($33.50 − $27) ÷ $27 | +24% |

| Max profit | Unlimited | — |

The stock must rise 24% to break even at expiration. However, the position can be profitable before expiration if the stock rises quickly—even if it’s still below $33.50—because the option retains time value.

ITM Call Example

SOFI trades at $27. You buy a $20 strike call (1 year out) for $9.00 ($900 total).

The $9.00 premium breaks down as:

- Intrinsic value: $27 − $20 = $7.00

- Extrinsic value: $9.00 − $7.00 = $2.00

| Metric | Calculation | Value |

|---|---|---|

| Max loss | Premium paid | $900 |

| Breakeven at expiration | Strike + premium = $20 + $9 | $29 |

| Required move to break even | ($29 − $27) ÷ $27 | +7.4% |

| Max profit | Unlimited | — |

The expiration breakeven is only 7.4% higher—less aggressive than the OTM call. And since it’s more expensive, you can’t buy as many contracts, which means less leverage.

But there’s a trade-off: added safety. If SOFI doesn’t move a penny through expiration, the ITM call retains 7/9ths of its value (the $7 intrinsic portion), while the OTM call loses 100%.

Entering, Exiting, and Expiration

To enter: Place a buy-to-open (BTO) order. Premium debits your account immediately.

To exit before expiration: Sell-to-close (STC) to realize your P/L without exercising. Your account is credited with the premium from the sale.

At expiration:

- OTM (stock ≤ strike): Expires worthless. Full premium loss.

- ITM (stock > strike): Auto-exercises if ITM by $0.01 or more. You buy 100 shares per contract at the strike price.

Watch your buying power. If you hold 10 contracts of the $30 call and SOFI is at $40 at expiration, auto-exercise means buying 1,000 shares at $30 per share:

$30 × 1,000 = $30,000 required

If you don’t have the capital, close the position before expiration.

Implied Volatility (Vega)

Implied volatility (IV) reflects the market’s expectation of future price swings. Rising IV means option prices are increasing as participants price in higher volatility ahead.

If you own calls through an IV increase, your position benefits—even if the stock hasn’t moved. Though rising IV typically accompanies strong directional moves, so you often get both.

The risk: buying before events (earnings, FDA decisions) means paying elevated IV. If the stock doesn’t move enough post-event, IV crush can erase your gains even if direction was right.

Adjusting a Long Call

If the trade moves against you, there’s not much you can do. You can convert to a bull call spread (sell a higher-strike call to collect credit), but this caps your upside and rarely beats entering a spread from the start—it’s damage control.

If most of your premium is already gone, you’re holding a lottery ticket: low probability, but asymmetric upside if the stock surges.

Risk Management

- Size conservatively. Risk only what you can afford to lose entirely.

- Favor longer durations. LEAPs (>1 year) give you more time to be right and slower theta decay.

- Match strike and expiration to your forecast. Be realistic about magnitude and timing.

- Avoid far OTM short-dated calls unless you have very high conviction.

- Plan exits. Set profit targets and stop-loss levels before entering.

- Watch IV. Avoid buying options when IV percentile is high (current IV is elevated compared to the past year’s levels).

Buying calls requires being right about direction and timing. Only buy when you have conviction the stock will move significantly within your timeframe.

Pros and Cons

| Pros | Cons |

|---|---|

| Unlimited upside potential | Can expire worthless (100% loss) |

| Defined risk (premium only) | Theta decay erodes value daily |

| Leverage with less capital | No dividends or voting rights |

| No margin required | IV crush can destroy value post-events |

Key Takeaways

- A long call delivers leveraged bullish exposure with risk capped at the premium.

- OTM calls: Cheaper, higher potential return, lower probability, lose 100% if stock stays flat.

- ITM calls: More expensive, higher probability, retain intrinsic value if stock stays flat.

- Max loss = premium paid.

- Max profit = unlimited.

- Breakeven = strike + premium.

- Theta is your enemy—the stock must move enough, soon enough.

- Auto-exercise occurs for options ITM by $0.01+ at expiration. Ensure you have buying power or close early.

- If a trade goes against you, there’s not much to do—but a nearly worthless call is a lottery ticket with asymmetric upside.

Long calls are simple in concept but challenging to trade profitably. They reward conviction and punish poor timing—approach with discipline and realistic expectations.

Ready to visualize your own call trades? Use our Long Call Option Calculator to calculate key metrics and visualize the P/L for any long call option inputs.